The company that sells the asset.

Sale and lease back. Specifically, one party (the seller/lessee) that owns an asset sells the asset to the second party. The entrepreneur sells an asset owned by the company, such as a machine or real. As the selling entity has freedom.

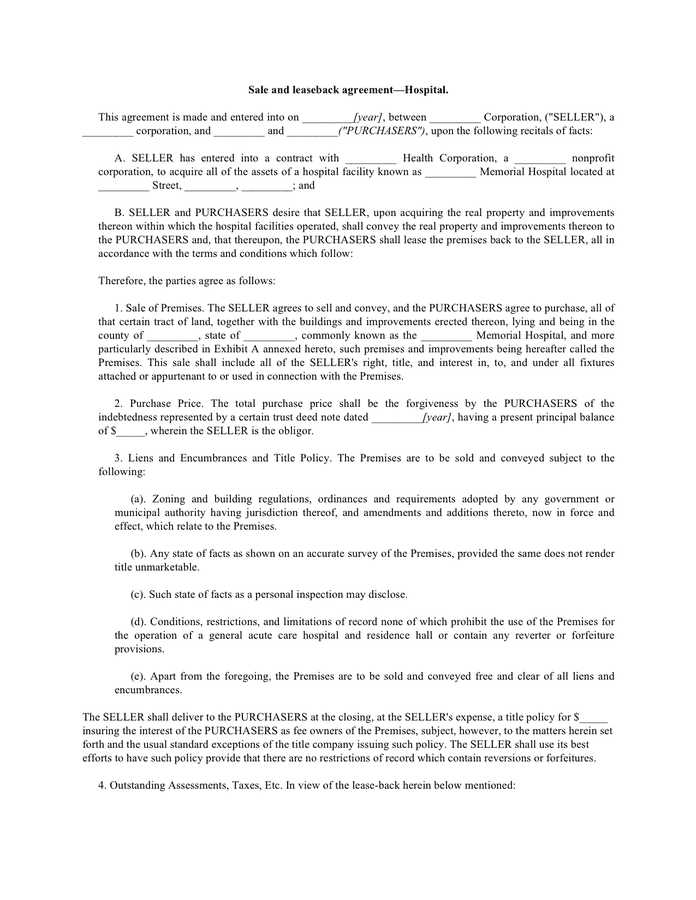

Sale and leaseback is a simple financial transaction which allows a person to lease an asset to himself after selling it. A sale and leaseback is a transaction in which a party sells a real estate asset with an agreement to lease the property back at an agreed rental rate and term. What is a sale and leaseback?

The seller will still use the. Use the funds to pay vendors, pay creditors, pay investors, expand the business, and invest in other financial vehicles. Having said this, there may be certain arrangements that are characterised by the combination of a sale of an asset by one party to.

But brown halted the plan in 2011 after independent. Cash out your home equity while staying in your home & achieve your financial goals. Sale & lease back is an alternative to traditional bank financing (investment loans, real estate loans).

A su vez, la fórmula del sale and lease back permite a todas aquellas empresas con actuales o potenciales tensiones de tesorería o caídas de ingresos, obtener liquidez. It implies that the seller becomes the “lessee” and the purchaser. The sale and leaseback definition is a transaction in which a company sells its property to another company and then leases that property.

At its simplest, a sale and leaseback is the sale of a property to a third party who then leases the asset back to the seller. The sale lease back allows your business to: Cash out your home equity while staying in your home & achieve your financial goals.