Weak combined ratios CRs.

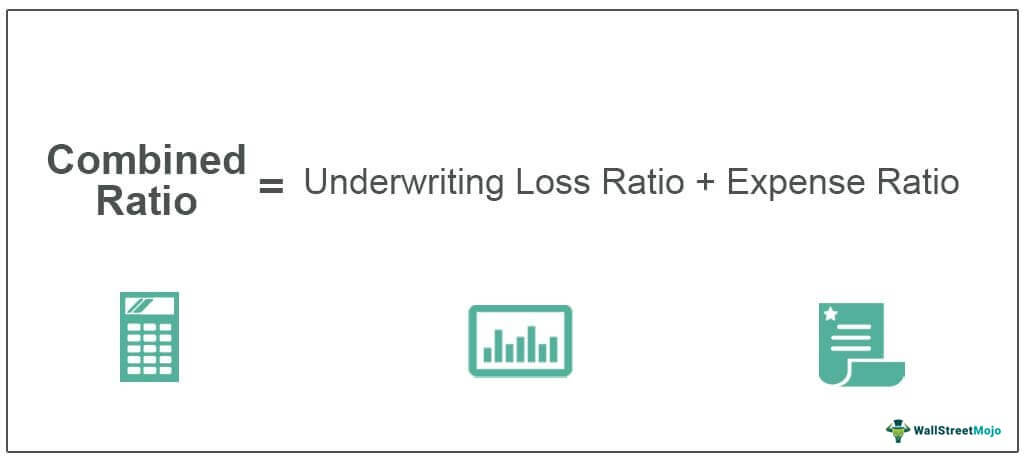

What is combined ratio for insurance company. Financial ratios are not an end by themselves but a means to understanding the fundamentals of an entity. The expense ratio is combined in practice with the loss ratio to give an insurance companys combined ratio. The formula is Combined Ratio Incurred Losses plus Expenses divided by Earned Premium.

These can be divided into five categories. The combined ratio is a measure of profitability used by an insurance company to gauge how well it is performing in its daily operations. The factors impacting Combined Ratio are simple - premium earned losses paid out and operating expenses.

The combined ratio also called the combined ratio after policyholder dividends ratio is a measure of profitability used by an insurance company to gauge how well it is performing in its daily. The Combined Ratio also known as Combined Operating Ratio or COR is an indicator of how much EARNED PREMIUM is consumed by claims and expenses. Combined Ratio the sum of two ratios one calculated by dividing incurred losses plus loss adjustment expense LAE by earned premiums the calendar year loss ratio and the other calculated by dividing all other expenses by either written or earned premiums ie trade basis or.

CARE follows a standard set of ratios for evaluating Insurance companies. If the costs are higher than the premiums ie the ratio is more than 100 then the underwriting is unprofitable. Insurers are experiencing challenges such as increased pressure on expense and loss ratios in the face of premium pressure claim losses and declining coverage demand in core areas such as small commercial and liability.

Berkshire Hathaways combined ratio ended the year at 1117 compared with 1104 in 2018 while the specialist Lloyds of London insurance and reinsurance marketplace saw its combined ratio strengthen to 1055 against 106 in 2018. Combined Ratio Incurred Losses ExpensesEarned Premiums. Financial ratios are used to make a holistic assessment of financial performance of the entity and also help evaluating the entitys performance vis-à-vis its peers within the industry.

That means youre operating at a profit rather. Combined operating ratio A measure of general insurance underwriting profitability the COR compares claims costs and expenses to premiums. Combined Ratio is a common vital indicator of a property and casualty PC insurance companys profitability.