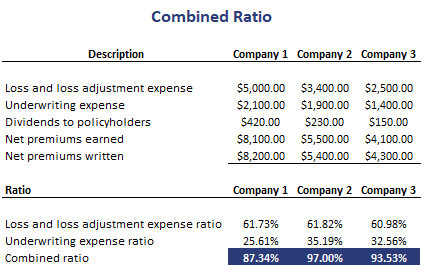

A combined ratio of more than 100 means that an insurance company had more losses plus expenses than earned premiums and lost money on its operations.

What is a good combined ratio in insurance. Ad Unlimited Number Of Claims. The combined ratio score of 987 indicates that Cincinnati Financial is doing a good job of creating profitability from their underwriting business. A combined ratio of less than 100 percent indicates underwriting profitability while anything over 100 indicates an underwriting loss.

Continuing with IAG and QBE the former posted a combined ratio of 1036 - an annual underwriting loss. The combined ratio is a quick and simple way to measure the profitability and financial health of an insurance company. Fast Repair Or Like For Like Replacement.

Likewise FM Global improved its CR to 8357 a. Ad Quick Quality Cover Without The Hassle. Ensuring easy access to accurate Combined Ratio figures is critical for underwriters.

Combined Ratio Loss Ratio Expense Ratio How the experts make Combined Ratio work for them. Improved its CR by 1337 points to top the list of Best Combined Ratios with an impressive industry-leading 4813. A combined ratio CR is the measure of underwriting profitability in insurance calculated using the sum of incurred losses and expenses divided by earned premiums.

Conversely a combined ratio of less than 100 means that a company had more earned premiums than losses plus expenses and is operating in the black while a combined ratio of exactly 100 is the break-even point. Get Insured Online Or Over The Phone. Insurers can have an underwriting loss a CR of more than 100 percent but still be profitable because of.

Which is great because the majority of the income they derive is through the generation of premiums. Online Quotes Get Insured Today. Ad Short Term Car Insurance Specialist.

:max_bytes(150000):strip_icc()/76755050-5bfc38bb46e0fb0083c41b0e.jpg)