Vacancy of property as mentioned above could limit the insureds recovery of damages.

What are not typical policy exclusions. But when theres a need for hospitalization it has to be covered. However beneficiaries may receive a refund of the premiums that have been paid. Insurance companies will typically not pay out a death benefit if the insured person commits suicide within two years after the purchase of the policy.

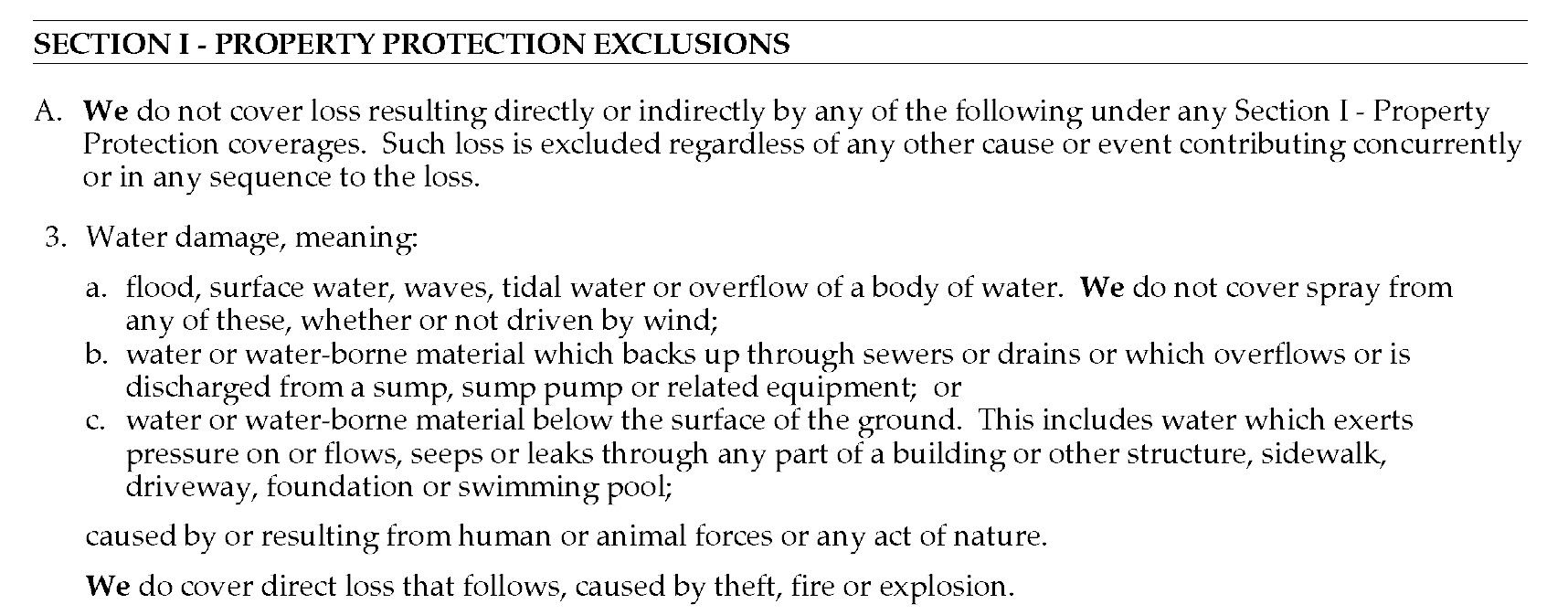

Exclusions are provisions in business insurance policies that eliminate coverage for certain types of property perils situations or hazards. Some policies will cover this and others wont. DO policies include an exclusion for losses related to criminal or deliberately fraudulent activities.

The reasons for exclusions to any policy including the CGL policy are varied. Lets look at the most common exclusions. The policy does not cover diseases as mentioned under Part C of the Workmens Compensation Act.

However if the peril which is insured under the policy happens due to pollution the damages suffered would not be covered. When something is noted as excluded on your. Risks described in exclusions arent covered by the policy.

However if your employees personal information was compromised your policy would likely cover employment-related privacy violations. All savings are provided by the insurer as per the IRDAI approved insurance plan. Suicide - Most life insurance policies list suicide as an exclusion.

Hurricanes are not specifically listed separately as being covered but most standard policies usually do cover wind damage caused by hurricanes. So if you deliver newspapers pizza food of any type medical supplies package delivery you may have no coverage under your personal auto policy for accidents or injuries under this exclusion. However fire insurance policies provide extension coverage for these instances.