This is a 5 digit number preceded by an E.

Watercraft exemption certificate. This exemption is not limited to the types of watercraft qualifying for the exemption provided by RCW 82080266. The buyer must provide proof of residency picture ID and check the applicable box. The term vessel for the purposes of RCW 820802665 means every watercraft used or capable of being used as a means of transportation on the water other than a seaplane.

EXEMPT ORGANIZATIONS If the purchaser is an organization that has been issued a certificate of exemption by Maine Revenue Services hospitals schools churches etc check box A and write the organizations exemption number in the space provided. The buyer must provide proof of. Watercraft exemption certificate substantially in the form set forth below.

Please refer to RCW 82080264 and WAC 458-20-177 for certificate and exemption information. The certificate shall relieve the seller from liability for the sales tax only if it is taken in good faith. KEEP A COPY FOR YOUR RECORDS.

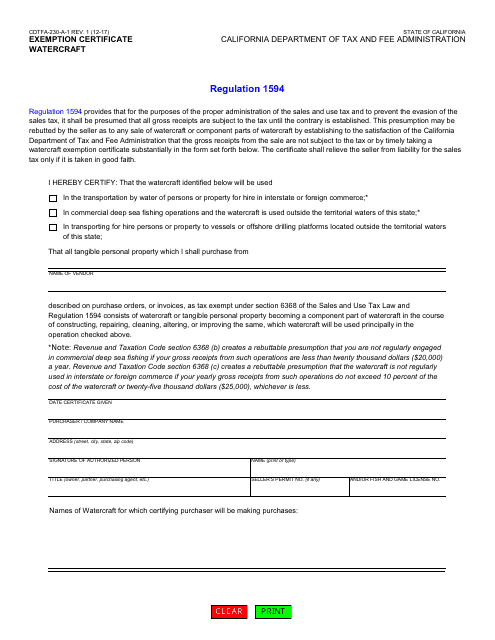

California law requires an annual assessment for property taxes on all watercraft vessels and general aircraft based on the location and value of the property on January 1 of each year. Completed exemption certificate from the buyer see individual and non-natural person examples. That the watercraft identified below will be used.

AircraftWatercraft Use Tax Transaction. Check applicable boxes 1. SC Code of Laws 1976 Section 50-23-345 d prohibits duplicating or updating temporary certificates or updating bills of sale.

This certificate is given with full knowledge of and subject to the legally prescribed penalties for. Manufacturing Machinery and Equipment. The certificate shall relieve the seller from liability for the sales tax only if it is taken in good faith.