It changes with an increase or decrease in the amount of goods or services produced or sold.

Variable cost per unit produced and sold. Contribution margin per unit equals sales price per unit p minus variable. Divide total variable cost by the number of units produced to get average variable cost. Therefore, the calculation of total variable cost will be as follows.

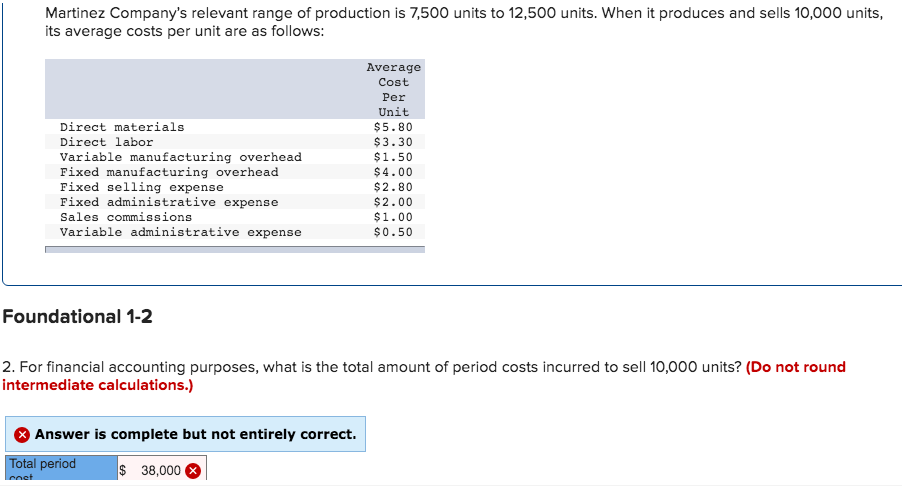

($30,000 fixed costs + $50,000 variable costs) ÷ 10,000 units = $8 cost per unit. When it produces and sells 10,000 units, question: If 18,000 units are produced and sold, what is the variable cost per unit produced and.

The formula for calculating unit variable costs is total variable expenses divided by the number of units. If 18,000 units are produced and sold, what is the variable. Variable cost is a corporate expense that changes in proportion to production output.

The total variable cost to a business is calculated by multiplying the total. A company named nile pvt. Variable production costs per unit and total fixed costs have remained.

What is variable cost per unit? Figure 6.9 number of units produced equals number of units sold. If 8,000 units are produced and sold, what is the variable cost per unit produced and sold?

Average fixed manufacturing cost per unit. Ltd produces handmade soaps, cost of raw material per unit is $5, the labor cost of. Total contribution margin (cm) is calculated by subtracting total variable costs tvc from total sales s.