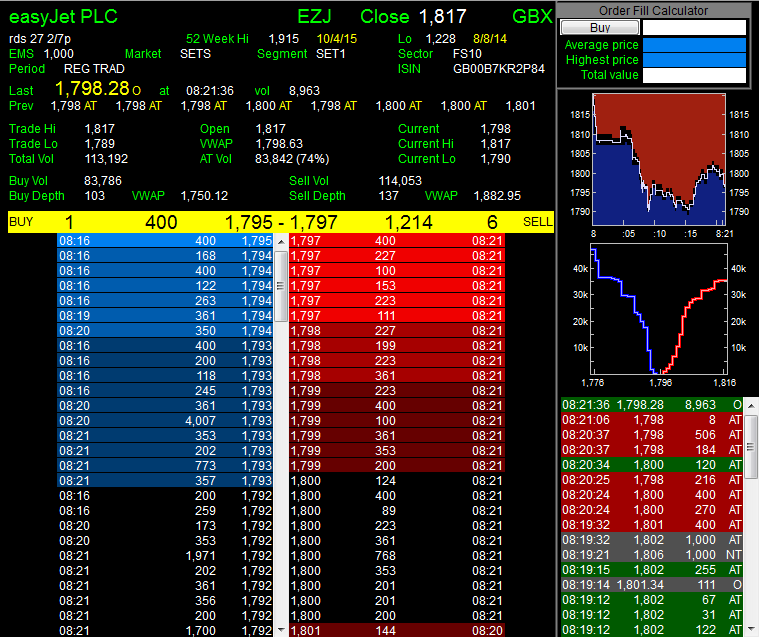

The level 2 market data provides investors with 40 levels of the best bids and offers that have been made upon a particular stock.

Read level 2 market data. For most investors, level 1 data will be adequate for their needs. Understanding level 2 and market makers. Level 2 is a generalized term for market data that includes the scope of bid and ask prices for a given security.

The investor can then tell how many buy. Level 2 trading is a tool used by traders to see bid ask spreads and where the buyers. Level ii market data shows multiple bid and ask prices from nasdaq for any given security so investors can better determine the availability or desire for a

Basic market data is known as level i data. Market information incorporates different pricing data, (for example, latest trading price), and different volume data, (for. The market players are awaiting key us cpi data due on tuesday this week.

Level 1 is a very simple representation of what the buyers and sellers currently have listed as their best prices. Introduction video on how to access and use level 2 data in robinhood. Helps you understand the dom.

So, for example, when trading assets on a stock exchange, options, or futures. When they know the market makers, they can identify their biases. Also called depth of book, level 2 includes the price book and.

22 2021, published 2:06 p.m. Level ii shows you the best bid/ask prices from each of the many different market makers. Up your investing game — how to read level 2 market data on robinhood.