Cov 1,2 = the covariance of the two assets, which can thus be.

Minimum varianz portfolio formel. $\begingroup$ it's not a coding issue so much as it's the result of using long short portfolios. How do you find the weights for a minimum variance portfolio? This would tell us what proportions of the two assets to use (for any amount x 0 > 0 invested) to ensure the smallest risk.

Wte = 1 is called the feasible set, where each point corresponds to a portfolio with the constraints met. In particular, the video details how to graph an efficient frontier and f. The parabolic curve is generated by varying the value of the parameter µp.

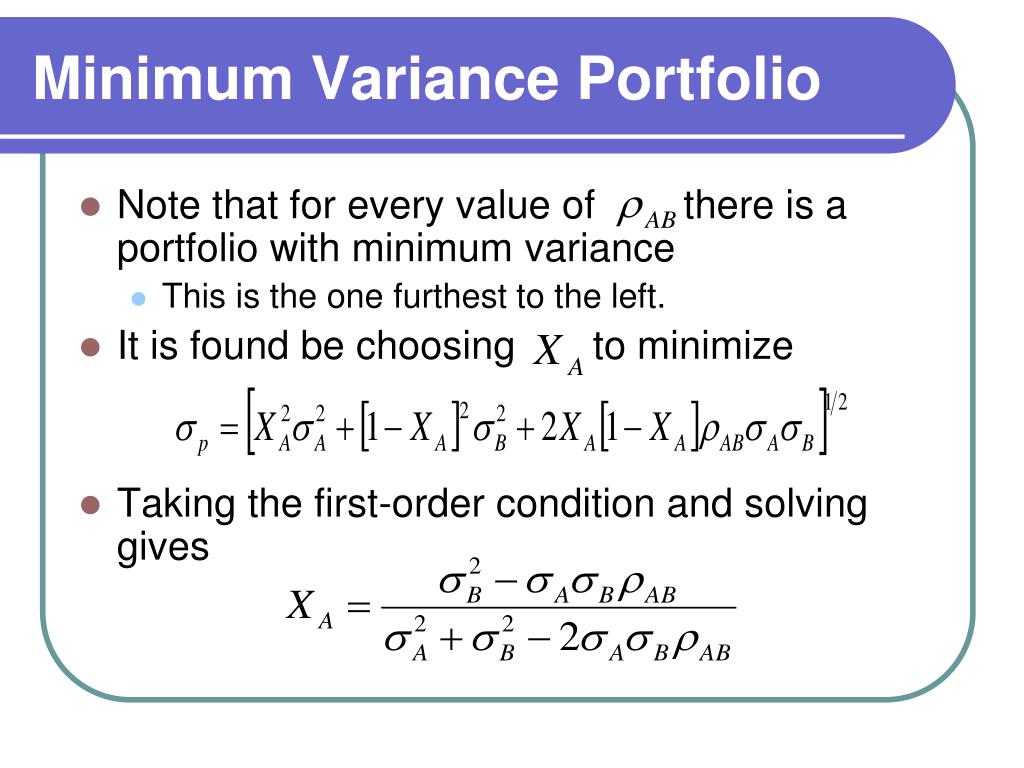

(7) our objective now is to find the value of α (denote this by α∗) yielding the minimum variance. You are free to use this image on your website, templates etc, please provide us with an attribution link. 1 2 var ( w) = 1 2 w ′ σ w → min w s.t.

It is the solution of the problem. If we want to find the exact minimum variance portfolio allocation for these two assets, we can use the following equation: Andrew calculates the portfolio variance by adding the individual values of each stocks:

S 1 = the standard deviation on. Northerntrust.com | minimum variance portfolio | 3 of 16 from equation 3 we have: The variance for a portfolio consisting of two assets is calculated using the following formula:

Mathematically, the portfolio variance formula consisting of two assets is represented as, portfolio variance formula = w12 * ơ12 + w22 * ơ22 + 2 * ρ1,2 * w1 * w2 * ơ1 * ơ2. This means that, instead of using both risk and return information as in the markowitz portfolio selection, the portfolio is constructed using only measures of risk. The set of minimum variance portfolios is represented by a parabolic curve in the σ2 p − µp plane.