The concepts “mergers and acquisitions” (m&a) and “restructuring” are primarily used as business terms, not as legal terms of art.

Mergers & acquisitions beispiele. Mergers and acquisitions (m&a) is the process through which companies consolidate through acquiring or merging with other companies. Wissenschafterinnen forschen kontinuierlich und intensiv zur thematik, alleine in der forschungsdatenbank ebsco können rund 50.000 verschiedene artikel zum thema abgerufen. This was called the most expensive mistake within the automotive industry.

Overpayment is a common pitfall of mergers and acquisitions. Aol and time warner now considered one of the worst (and largest) m&a disasters in history, the aol and time warner merger was initially anticipated to create exciting synergies and results. Some notable hostile takeovers include.

This definition is intentionally broad, as m&a can include the acquisition of a company’s assets as well as its equity. A list of the biggest mergers and acquisitions. As an aspect of strategic management, m&a can allow enterprises to grow or downsize, and change the nature of their business.

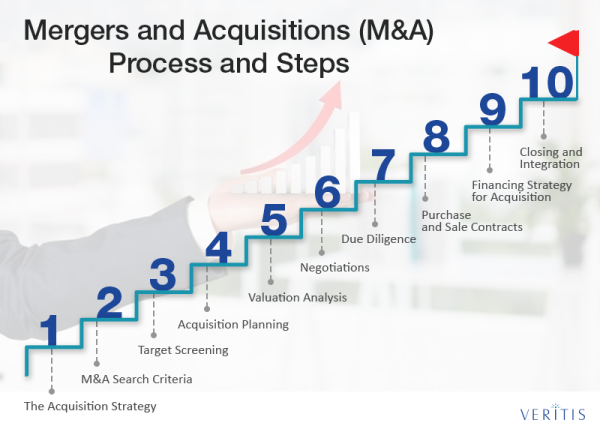

In addition to the seller, you may be getting urged by intermediaries involved in the agreement, as well as by teams within your own company. And ford motors (jaguar and land rover brands) price $2.3bn. The mergers and acquisitions (m&a) process has many steps and can often take anywhere from 6 months to several years to complete.

Mergers and acquisitions involve a series of processes and can take months or years before the parties agree. M&a is one of the major aspects of corporate finance world. M&a transactions can be divided by type (horizontal, vertical, conglomerate conglomerate a conglomerate is one very large corporation or company, composed of several combined companies, that is formed by either takeovers or mergers.

They are not sharply defined, instead referring to fuzzy sets of similar transactions. Mergers and acquisitions (m&a) is a general term that describes the consolidation of companies or assets through various types of. Mergers occur when two entities come together to form a single company.