To open a level ii window in ninjatrader, from the control center click new > level ii.

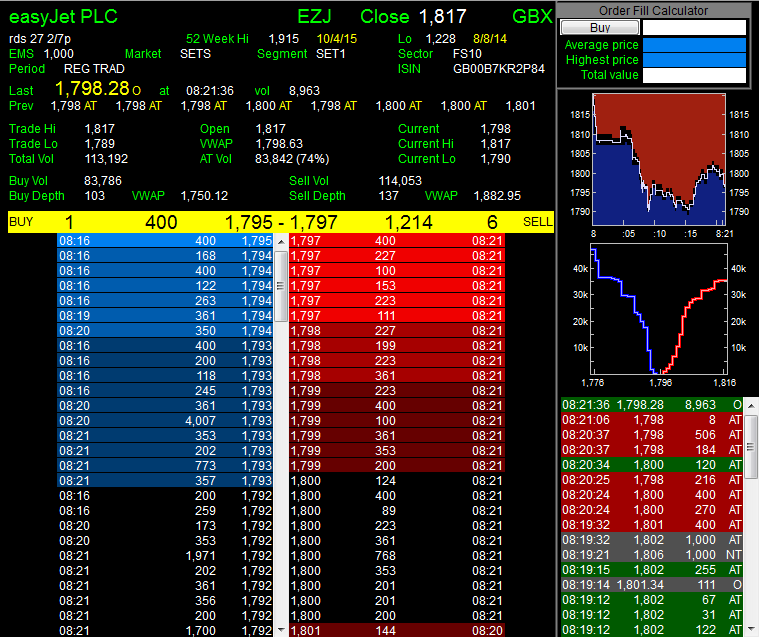

Level ii market data. When they know the market makers, they can identify their biases. The below example shows the 2100 market maker signal code (let the price run). Level 2 trading is a tool used by traders to see bid ask spreads and where the buyers.

The vgls stock price is. The more basic of the two types, level 1 market data generally provides the following information; For most investors, level 1 data will be adequate for their needs.

However, for active traders and investors, level 2 data will provide greater market depth and insights. Level ii shows you the best bid/ask prices from each of the many different market makers. The level 2 market data provides investors with 40 levels of the best bids and offers that have been made upon a particular stock.

Investors can use level 2 data to differentiate between different market players such as retail and institutional investors. Level 2 market data provides additional information to level 1 market data, it shows the highest 5 or 10 (depends on market and instrument) bid prices/bid sizes, and the. Level ii market data might be required for some trading strategies that attempt to isolate strong buyers or sellers in the level ii data.

Level ii shows you who the. The quotes section displays market data items such as bid, ask, last, open, high, low,. Level 2 market data is a set of detailed information about asset prices, offers and trading volumes.

Level 2 (ii) market data is offered by data providers at a premium to level 1. The investor can then tell how many buy. This tutorial will explain how traders use level 2 market data to determine if a stock is bullish or bearish and more.