Analysts and investors usually express this ratio as a percentage.

Insurance combined ratio meaning. The combined ratio is a measure of insurer profitability calculated. Combined Ratio Incurred Losses ExpensesEarned Premiums. What is Combined Ratio used for.

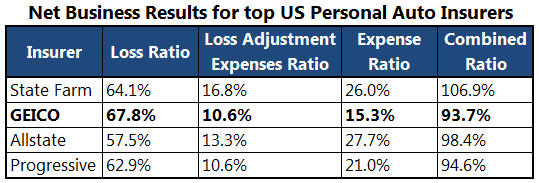

A combined ratio of less than 100 indicates an underwriting profit while anything over 100 indicates an underwriting loss. Combined Ratio is a measure of performance used by underwritersinsurance companies. The combined ratio is a measure of profitability used by an insurance company to gauge how well it is performing in its daily operations.

We can calculate the combined ratio by taking the sum of the incurred losses and expenses and then dividing them. If the costs are higher than the premiums ie the ratio is more than 100 then the underwriting is unprofitable. A combined ratio of less than 100 percent indicates underwriting profitability while anything over 100 indicates an underwriting loss.

Float or available reserve is the amount of money on hand at any given moment that an insurer has collected in insurance. Combined Ratio A measure of profitability used by insurance companies to indicate how well it is performing in its daily operations eg. Claims The combined ratio of an insurer or a reinsurer is the combination of its loss ratio and expense ratio.

The formula is Combined Ratio Incurred Losses plus Expenses divided by Earned Premium. The company may still be profitable if investment income covers the shortfall. The combined ratio measures whether the insurance company is.

The combined ratio is a calculation insurance companies use that shows how profitable they are. Combined Ratio is perhaps the most useful way to determine the profitability of an underwriting operation. CARE follows a standard set of ratios for evaluating Insurance companies.

:max_bytes(150000):strip_icc()/GettyImages-174656642-d26823be49f9495598b04651494a869f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1055247044-11273b0978844d7c96980190d0951498.jpg)

:max_bytes(150000):strip_icc()/76755050-5bfc38bb46e0fb0083c41b0e.jpg)

/dotdash_final_Optimal_Use_of_Financial_Leverage_in_a_Corporate_Capital_Structure_Dec_2020-01-33c6c3ed09c343f6a6693266ee856c8e.jpg)