The expense ratio formula is calculated by dividing the fund’s operating expenses by the average value of the fund’s assets.

How to calculate variable expense ratio. How to calculate it the variable expense ratio, sometimes called the variable cost ratio, is an accounting tool used to show an organization’s variable production costs as a percentage of. However, the expense ratio presented in any printed documents will be. Expense ratio = management fees / total investment in the.

To calculate the variable expense ratio, simply divide the company’s total variable expenses by. Determine the expense ratio of the fund for the year 2019. To calculate variable expenses for the year, the manager must multiply each expense by 12 to get the yearly costs.

Put the values in the above formula. For example, if the price of a product is $100. Yearly expected investment return = 13.59 %.

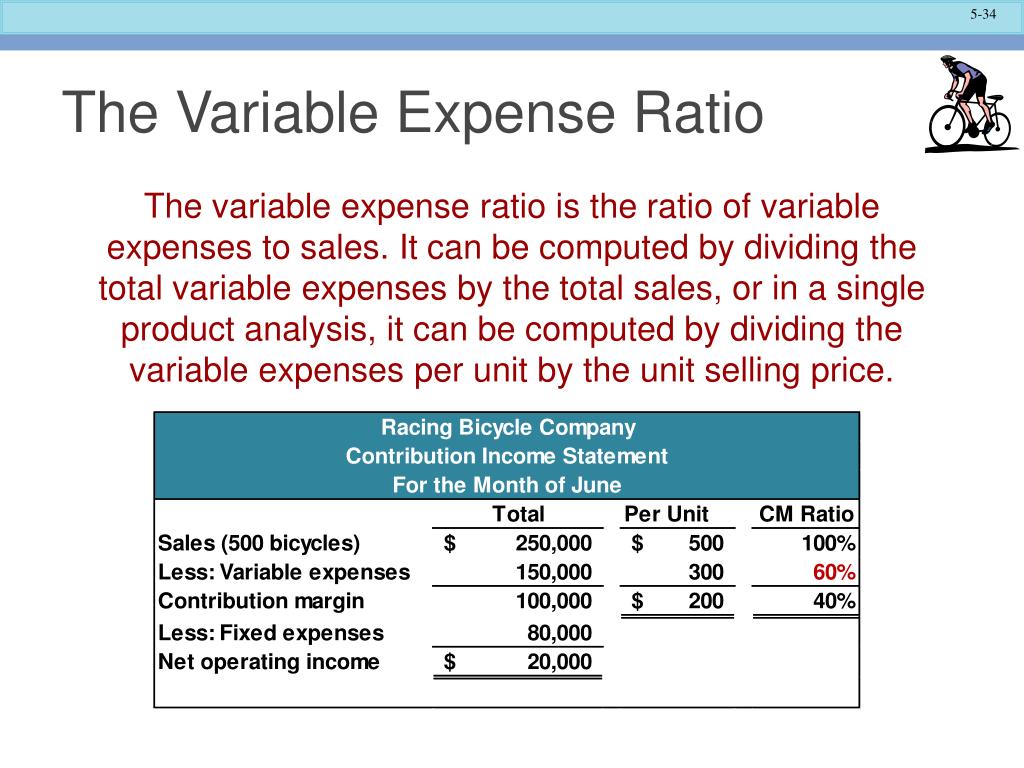

Variable expense ratio expresses variable expenses as a proportion of a company’s sales. Variable cost ratio squash $400,000 $600,000 67%. Now, we are going to do the same calculation but with the spy etf information:

An expense ratio is determined through an annual. Administrative expenses are $2,500, selling expenses are $3,200 and. Why the variable expense ratio matters.

When the ratio is off, companies spend money faster than they. Expense ratio spy = 0.0945%. Total variable cost = $20,000 so, total variable cost of 1000 boxes is $20,000.