New comments cannot be.

How much does e&o insurance cost for realtors. Many real estate brokers sell EO insurance to their sales agents as part of a larger package of services provided to the agent for a flat fee. A missing contract clause or a failure to review a sellers property disclosures could. How Do Brokers Apply the Per-Transaction Costs Across their Agents.

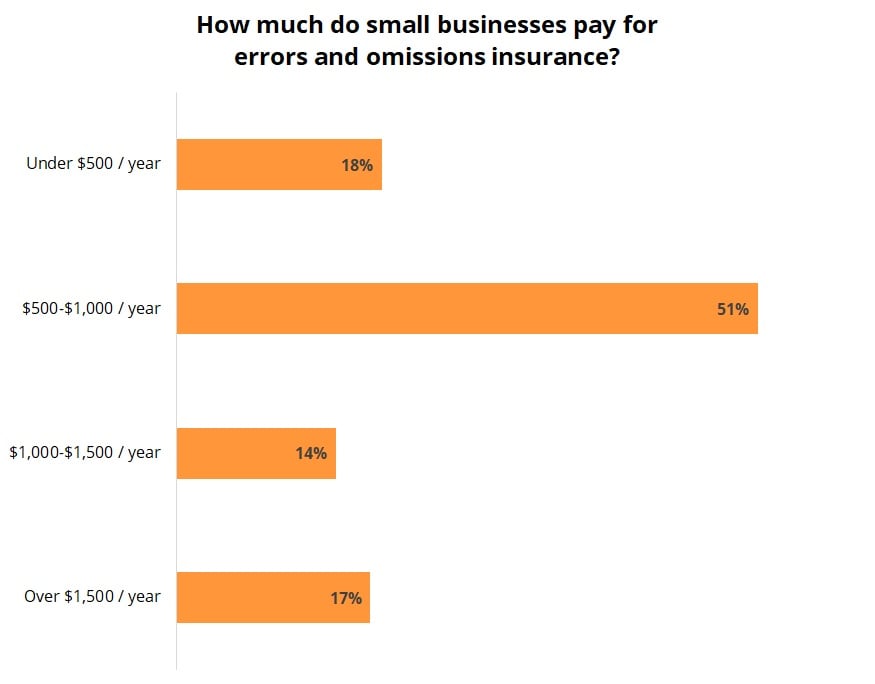

Such insurance tends to be expensive ranging from several hundred to several thousand dollars per year. Agents dont always think about the particulars of this important insurance policy. How does EO insurance work.

The cost increases depending on the risk of a business being sued over a professional mistake. The median cost of errors and omissions insurance for real estate businesses is about 55 per month or 665 annually. Based on the quotes we got from the 2 companies that we recommended below the real estate EO insurance cost is in the range of 30-60 a month.

This thread is archived. Among real estate businesses that purchase errors and omissions insurance with Insureon 38 pay less than 600 per year and 44 pay between 600 and 1200 per year. They just know they have.

How much is E and O insurance for Realtors. Get Insurance Quotes From AUs Leading Brands in Mins. When you purchase real estate EO insurance you enter into an agreement with an insurer for it to pay for your loses up to your policy limits as long as you pay your premiums.

Insurance does NOT provide coverage for events that took place prior to the inception date of the policy. The average price of a standard 10000002000000 General Liability Insurance policy for small real estate agent ranges from 27 to 39 per month based on location size payroll sales and experience. A real estate broker managing listings worth 10 million dollars will need a different real estate EO policy from the one that is obtained by a new real estate agent.