A bank credit memo is an item on a companys bank account statement that increases a companys checking account balance.

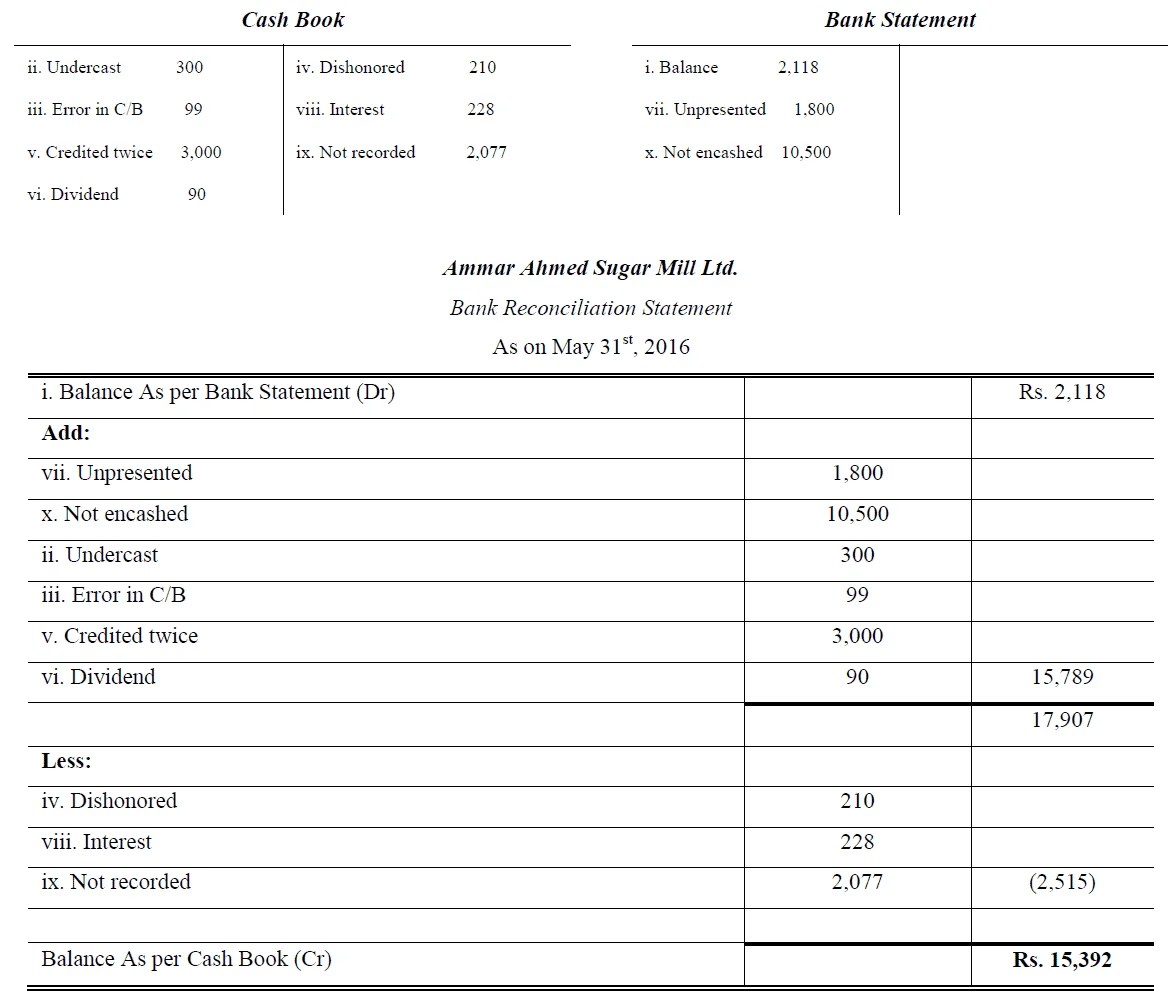

Example of credit memo in bank reconciliation. What is debit memo in bank reconciliation. A few examples of errors and omissions are given below that lead to a greater bank. Bank Reconciliation Formula Example 1 From the following particulars prepare Bank Reconciliation statement for Ms XYZ and company as at 31st December 2018 Balance as per Bank Book is 8000 Cheques issued of Rs.

C Wrong Casting of Bank. Errors Resulting in More Bank Balance in the Cash Book. Notification that a customers check for 375 was recorded by the company as 735 on the deposit ticket 75.

The bank adding interest that was earned for having money on deposit. A debit memorandum or debit memo is a document that records and notifies a customer of debit adjustments made to their individual bank account. Sometimes a check issued to creditors is omitted from being recorded in the cash book on the credit side in the bank column or it is wrongly recorded in the cash column.

On June 29 the bank statement showed a bank credit memo of 1000 which caused the checking account balance to increase. Cheque of 500 issued on 31 st December 2018 was not presented for payment. This leads to more bank balance in the bank statement.

The reasons a debit memorandum would be issued relate to bank fees undercharged invoices or rectifying accidental positive balances in an account. Click to see full answer Beside this. We were originally invoiced for a unit over a year ago we recently received a credit memo for the total amount of the unit and then were rebilled for the unit at a discounted price.

This is achieved by the following journal entry. Examples of Bank Credit Memo in a Bank Reconciliation A few examples of a bank credit memo appearing in a companys bank account include. Examples of Bank Credit Memo in a Bank Reconciliation A few examples of a bank credit memo appearing in a companys bank account include.