Is that you should file your Canadian tax return before April 30th each year.

Can i file my taxes after the deadline canada. So its always better to file your taxes as early as possible and on or before the due date. Yes filing late is better than not filing at all. Find the forms and calculators for back taxes here.

Can I file my taxes after the Canadian tax deadline. You can pay Canadian taxes in a number of different ways. Deadline to pay your taxes.

That penalty alone. It is open 21 hours-per-day not open from 1am to 4am daily for maintenance. The answer that nobody talks about thats a little bit more exciting is that you can file your tax return any time of year even after the deadline.

Also you may get benefits payouts delayed such as GST or child tax benefits. So when your T2 tax return is due depends on your corporations fiscal year end. The corporation is a Canadian controlled private corporation and.

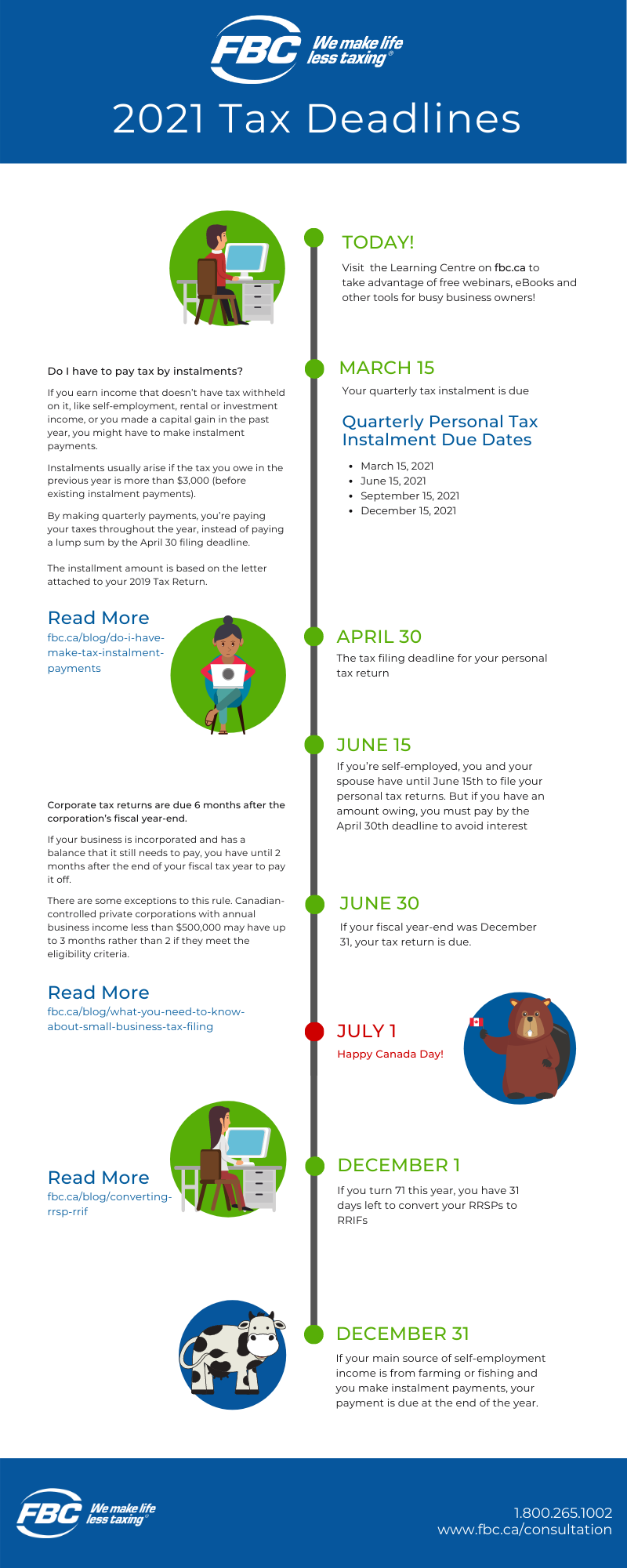

We hold income tax refunds in cases where our records show that one or more income tax returns are past due. The deadlines for filing corporate T2 returns are within six months of fiscal year-end but any taxes owed must be paid within two months of fiscal year-end or three months if. Payment date for 2020 taxes.

For one youll pay a 5 late-filing fee applied to your tax bill. If you file after September 30 the CRA will charge you a late-filing penalty as well as compound daily interest on the penalty. The late filing penalties for Canadian corporations are the same as for individuals as listed above.