Business liablity insurance ms protects your company from lawsuits with rates as low as $57/mo.

Business liability insurance mississippi. General liability plans must be tailored to the needs of your business and employees. At bishop insurance, we’ve got the answers you need to make informed coverage decisions! Business liability insurance in mississippi protects your company’s assets and pays for claims that arise when someone gets hurt on your property or when property damage or injuries are.

Simply business builds customized coverage for your business. Get customized coverage + low monthly payments. At the nowell agency, inc., we specialize in providing general business liability insurance to clients all.

However, mistakes can and do happen, sometimes resulting in property. According to the hartford’s data, the average cost of a general liability claim that turns into a lawsuit is $75,000—and that doesn’t take into account the cost. Professional liability insurance protects your business against loss from a claim of alleged negligent acts, errors or omissions in the performance of your professional services.

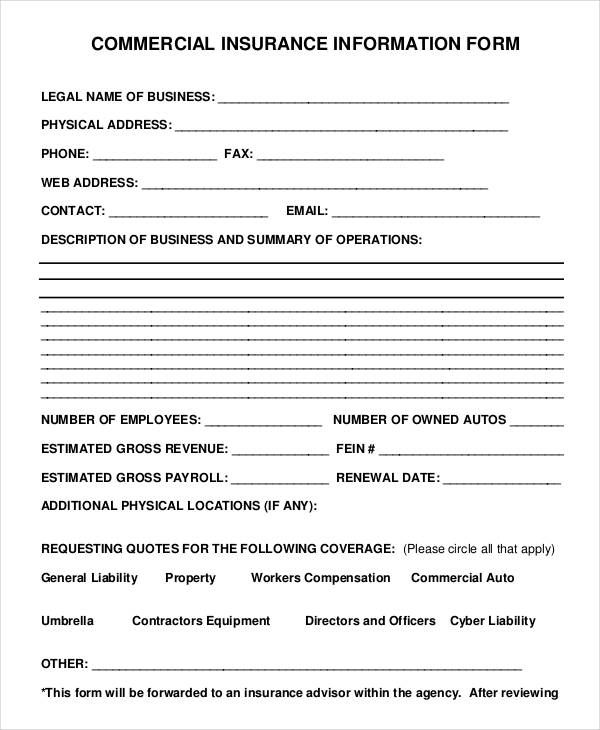

Ad protect yourself & your budget. Business property business interruption professional liability hired and. This agency is responsible for regulating all insurance policies sold in the state, including commercial liability coverage.

Businesses often use general liability to protect. This policy covers the cost of accidents involving work vehicles. Protect your hard work with proper business insurance in mississippi.

Mississippi car insurance, auto insurance in mississippi, best. The state of mississippi requires businesses with five or more employees to carry workers’ compensation insurance. The size of your business, industry, and number of employees will have the biggest role in determining insurance requirements for your business.