Here is a list of exclusions that dont fall under the scope of a Life Insurance policy.

All of these are common exclusions to a life insurance policy except. All types of insurance policies have certain exclusions and limitations and may exclude the insured person from cover in certain circumstances. Act of war exclusion. Answered Apr 26 by.

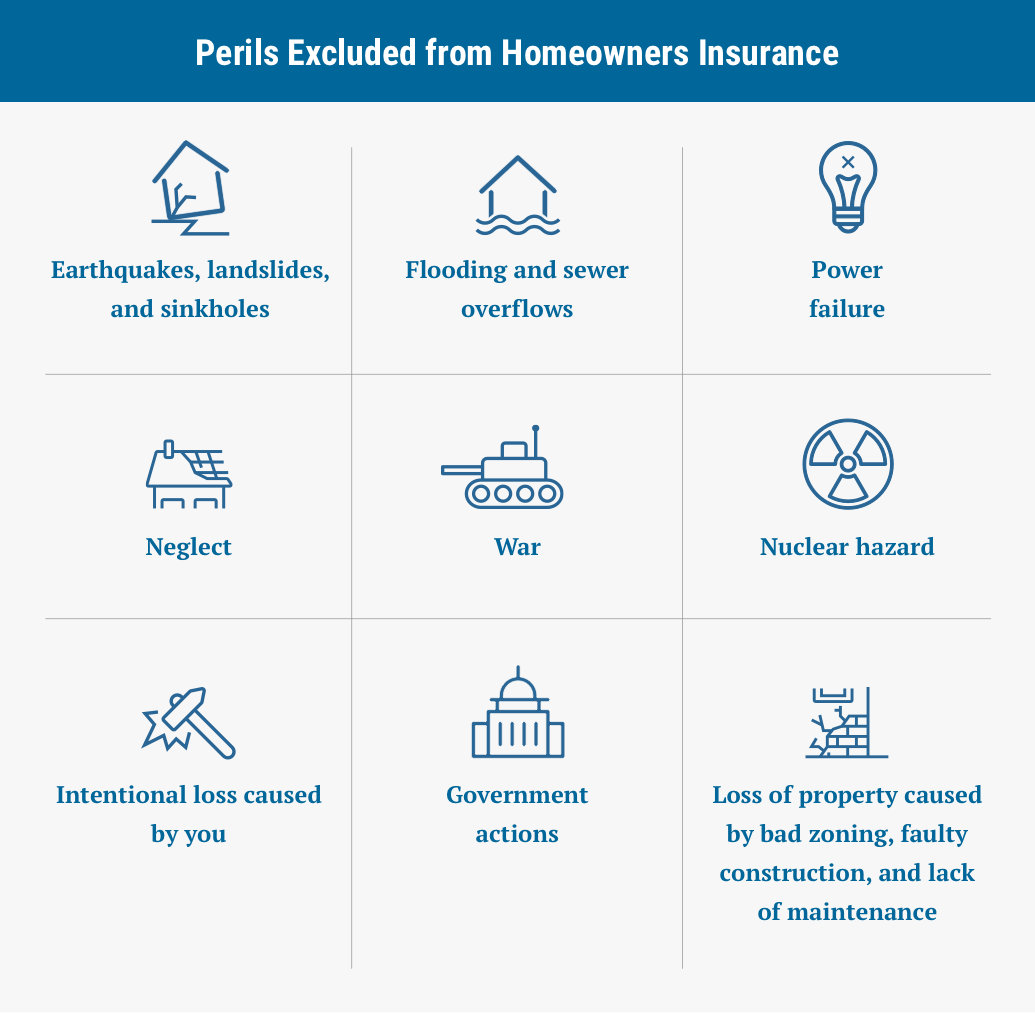

Common exclusions in accident and health insurance policies include all of the following except. 5 Common Life Insurance Exclusions. Exclusions are provisions in business insurance policies that eliminate coverage for certain types of property perils situations or hazards.

All You Need To Know About TDS On Life Insurance Policies. Pre-existing diseases are diseases which the insured has been suffering from at the time of applying for the policy or prior to cover commencement. Knowing that these are not covered by insurance also encourages your agency and others to invest more time in planning to prevent these from occurring.

Health insurance policies usually never insure any medical treatments present from birth which means the insurance doesnt cover any genetic diseases. Updated April 16 2021. The most common life insurance exclusions are.

Medical expenses covered under Workers Compensation. As per the policy the sum assured in the Life Insurance policy should be paid to the nominee on the death the policyholders death. A cosmetic surgery to repair a cleft palate B workers compensation C elective cosmetic surgery D intentionally self-inflicted injuries.

D routine eye care. Medical expenses covered under workers compensation. Suicide - Most life insurance policies list suicide as an exclusion.