Once you start driving for Uber you must let your insurance company know.

Will driving for uber raise my insurance. If your current premium is around 600 per year then rideshare. This policy gives drivers 50000 of bodily injury liability coverage per driver 100000 of bodily injury liability coverage per accident and. Prepare for a rise in your insurance rate.

I submitted my drivers license car registration and car insurance to Uber. And if you use Uber make sure you ask for this proof of your drivers personal insurance. State Farms rideshare coverage adds about 15 to 20 to your current auto insurance premium.

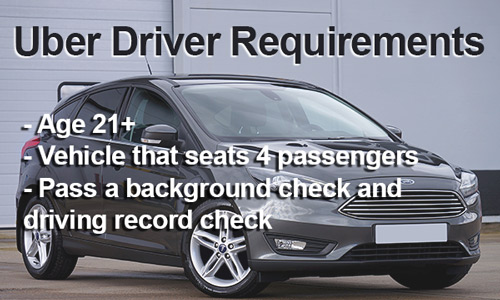

When you read the terms and conditions youll notice that Uber refers to its drivers as independent contractors. You do not pay for Ubers driver insurance policy since its charged to the customer. In some states the only requirements for UberX drivers are car insurance appropriate age health completion of a driving test and passing a background check.

The Uber purchased policy provides 2 million in liability. 2 1 mo ago. If youre engaged in ridesharing activity and are responsible for a collision basic plate insurance will still apply.

5 Does Uber Eats increase your insurance. It covers gaps left in Uber and Lyfts auto insurance or any other TNC you drive for. It is unlikely your personal insurance policy will cover you and Uber only offers limited liability.

Uber requires they have it. Unfortunately the insurance industry is usually slow to keep up with the needs for ride share insurance. During period one your Uber app is on and you are waiting for a Uber ride request.