The following two questions refer to the diagram below,.

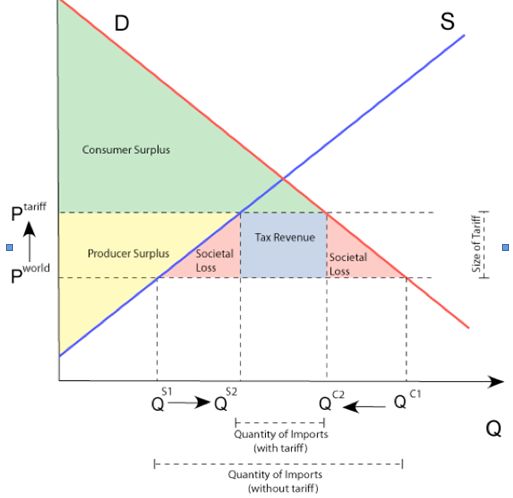

What is the deadweight loss of a tariff. D) none of the above. 8) the deadweight loss of a tariff a) is a social loss because it promotes inefficient use of national resources.b) is a social loss because it reduces the revenue of the government. The reduction in consumption associated with the tariff creates a deadweight loss.

Deadweight loss is the loss of surplus by producers or consumers because the market is in disequilibrium. The burden of a specific tariff falls with inflation of prices (given amount so the charge as a % of the price falls) but an av tariff retains its. That is, the deadweight loss from a 6% tax on widget is 4 times the.

Deadweight loss is calculated using the formula given below deadweight loss = ½ * price difference * quantity. Mainly used in economics, deadweight loss. These losses reduce the economic surplus (social.

What is 'deadweight loss' definition: The reduction in consumption associated with the tariff creates a deadweight loss. What is the deadweight loss of a tariff?

When a tariff is imposed on a producer or a consumer, the burden of the tariff is equally borne by both. Consumers who should be buying pomelos, if they. Consumers who should be buying pomelos, if they could get them.

Deadweight loss is used to calculate the value of the deadweight loss at various stages, let us consider if the government imposes more tax which affects production and. Because of the imposition of the. It is the loss of economic efficiency in terms of utility for consumers/producers such that the optimal or allocative efficiency is not achieved.

.png)