Whole life insurance is the most common type of permanent life insurance and costs more than term life.

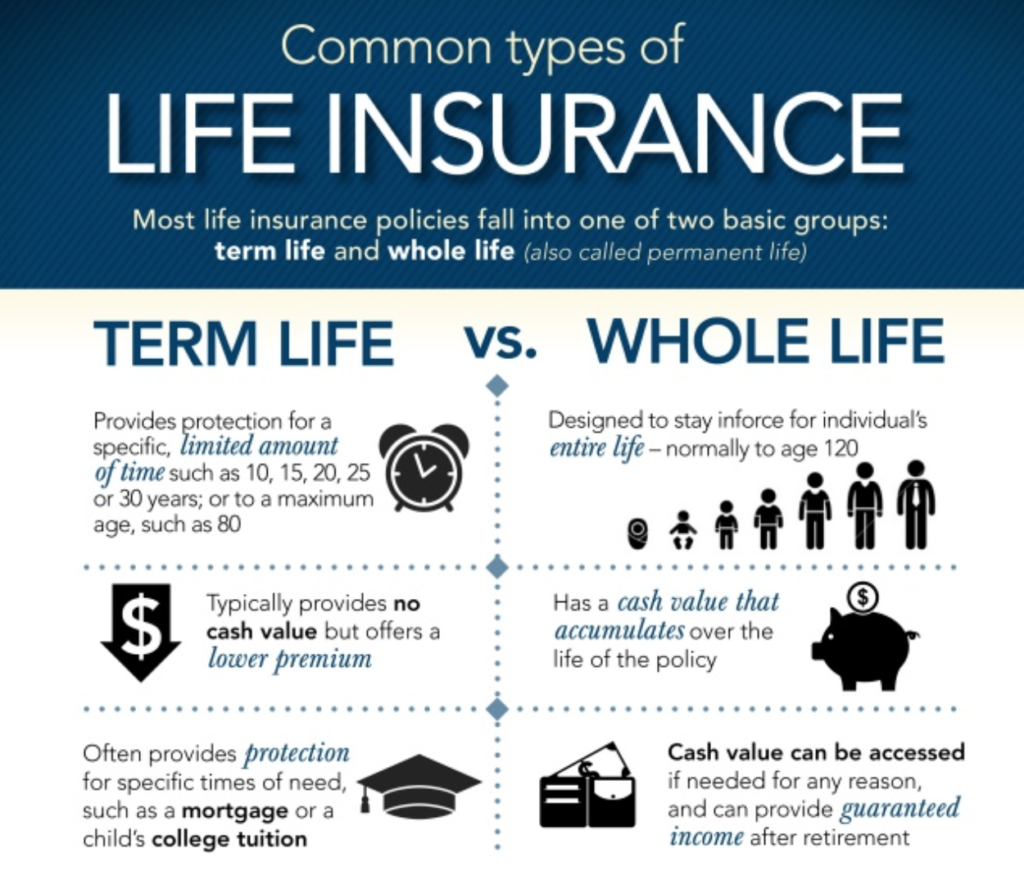

What is term life insurance. Term is the purest form of life insurance — it’s designed to pay your beneficiaries if you pass away prematurely, and that’s it. A term insurance plan is the most. Term life insurance is a type of life insurance policy that has a specified end date, like 20 years from the start date.

This is the cash your beneficiary. Your term life insurance length is determined by the policy term you’ve purchased. It provides large cover for a.

Term life insurance only lasts for a set number of years and the death benefit will only be paid out if you die within the policy term. A term insurance plan is a pure life insurance product that offers financial protection to the family of the policyholder at low premium rates for a fixed time period. Term life insurance offers temporary financial protection — usually five to 30 years — for a low, fixed cost.

Term life insurance pays a death benefit, but only if you die during the term the policy is in effect. The term life insurance benefit is paid as a lump sum amount so that your family can use the money to pay off debts such as the mortgage or credit cards, plus use the money as an income. Ad find out if max life insurance is the best option for you and your loved ones.

Term life insurance is a policy that lasts for a specific period of time, typically ranging from 10, 20, or 30 years to specific ages. You pay premiums until the expiry of the. A range of health insurance plans to suit your needs.

Term policies aren’t weighed down by complicated. So if you die a year after the. Term life insurance covers a fixed period.

![10 Year Term Life Insurance [Top 10 Companies and Tips]](https://i2.wp.com/www.lifeinsuranceblog.net/wp-content/uploads/2017/01/Term-Life-Insurance.png)