Using this example the first number means that 250000 would be paid for bodily injury to each person 500000 is the amount of bodily injury that would be paid to.

What is split limit insurance coverage. The second limit is a per occurrence limit. Split limit insurance policies offer multiple limits or limits per type of expense. Split Limit Liability is the more commonly used type of liability coverage.

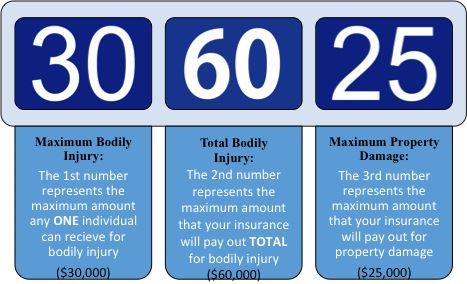

Ad Start saving by comparing health insurance policies from UKs award-winning insurers. A Split Limit Liability auto policy is split into three parts. Under the split limit coverage these numbers would mean that you have 50000 of bodily injury coverage per person per accident 100000 total for all injuries per accident and a 25000 limit for property damage done in one accident.

This coverage pays a certain amount for each injured person and a total amount per accident for all injured persons. It specifies limits for three specific types of claim. Our quotes come with free impartial specialist advice you can trust.

They also slice BI coverage into a limit per person and per incident. Ad Start saving by comparing health insurance policies from UKs award-winning insurers. An example of a standard Split Limit policy may look like this.

Split limit liability insurance uses three different amounts for three different aspects of your coverage -- individual bodily injury bodily injury for an accident no matter how many people are involved in it and property damage liability. There are three areas you need to be aware of when it comes to split limit coverage and they are bodily injury per person bodily injury per accident and property damage coverage. This means 100000 medical bodily injury coverage per person 300000 bodily injury coverage for the entire accident and 50000 total property damage limits.

Split limits coverage is a set of limits on payments for auto insurance claims that is split into different categories. Split limit coverage splits the coverage amount into three limits such as 5010025. Split Limit Liability Coverage.