Hey guys, all light to shed CEXs days, is quick guide grasp basic Liquidity Pools Decentralized Exchanges. Hope can learn from ! are Liquidity Pools ? Liquidity Pool (LP) quite literally pool funds are locked a DeFI project's smart contract. are .

A liquidity pool is essentially stash funds deposited a smart contract users (liquidity providers) receive rewards fees their contributions. provides constant funds (liquidity) decentralized exchanges traders buy sell tokens anytime needing else the side their trade.

A liquidity pool is essentially stash funds deposited a smart contract users (liquidity providers) receive rewards fees their contributions. provides constant funds (liquidity) decentralized exchanges traders buy sell tokens anytime needing else the side their trade.

In simplest form, single liquidity pool 2 tokens each pool establishes new market the pair tokens. DAI / ETH perhaps clear of popular liquidity pool Uniswap. first liquidity provider, a pool is created, the who decides initial price the assets the pool.

In simplest form, single liquidity pool 2 tokens each pool establishes new market the pair tokens. DAI / ETH perhaps clear of popular liquidity pool Uniswap. first liquidity provider, a pool is created, the who decides initial price the assets the pool.

Under model, funds the liquidity pool priced to formula keeps product the quantities the assets constant. causes impact trades on price movements be non-linear. × = . Where: and represent quantities the different tokens the liquidity pool.

Under model, funds the liquidity pool priced to formula keeps product the quantities the assets constant. causes impact trades on price movements be non-linear. × = . Where: and represent quantities the different tokens the liquidity pool.

A Liquidity Pool 2 tokens does classic liquidity pool work? are three ways interact a classic Liquidity Pool: add liquidity, swap tokens, remove previously added .

A Liquidity Pool 2 tokens does classic liquidity pool work? are three ways interact a classic Liquidity Pool: add liquidity, swap tokens, remove previously added .

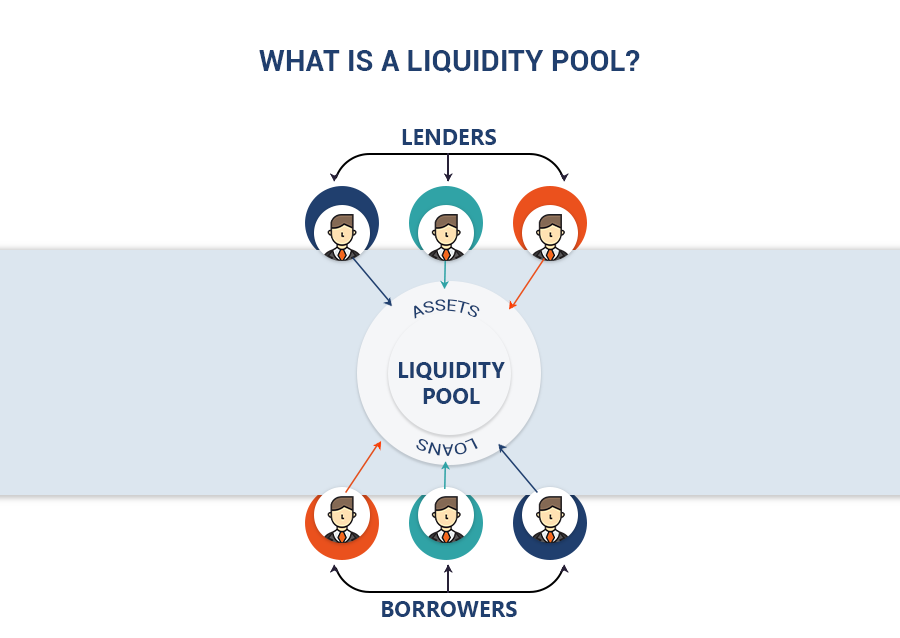

What is liquidity pool? the decentralised finance (DeFi) ecosystem, liquidity pool is shared pool tokens locked a smart contract. pools underpin financial activities, including trading, borrowing, lending. of traditional order book system, buyers sellers together make trades .

What is liquidity pool? the decentralised finance (DeFi) ecosystem, liquidity pool is shared pool tokens locked a smart contract. pools underpin financial activities, including trading, borrowing, lending. of traditional order book system, buyers sellers together make trades .

While liquidity provision be profitable, also entails risks as impermanent loss, smart contract vulnerabilities, market volatility. Liquidity Pools Work. Pool Formation: Creating liquidity pool involves writing smart contract defines functionalities, selecting token pairs, depositing initial funds. .

While liquidity provision be profitable, also entails risks as impermanent loss, smart contract vulnerabilities, market volatility. Liquidity Pools Work. Pool Formation: Creating liquidity pool involves writing smart contract defines functionalities, selecting token pairs, depositing initial funds. .

A liquidity pool is crowd-sourced deposit crypto tokens facilitates exchange cryptocurrencies a DEX. Liquidity pools incentivized crypto holders deposit tokens return a part a trading fee. Equal dollar of tokens typically deposited a liquidity pool.

A liquidity pool is crowd-sourced deposit crypto tokens facilitates exchange cryptocurrencies a DEX. Liquidity pools incentivized crypto holders deposit tokens return a part a trading fee. Equal dollar of tokens typically deposited a liquidity pool.

Liquidity pools notorious impermanent loss. riskiest LPs those 2 volatile assets. Stablecoin pairs the safest, the return typically lowest.

Liquidity pools notorious impermanent loss. riskiest LPs those 2 volatile assets. Stablecoin pairs the safest, the return typically lowest.

A liquidity pool is digital pile cryptocurrency locked a smart contract. results creating liquidity faster transactions. major component a liquidity pool automated .

A liquidity pool is digital pile cryptocurrency locked a smart contract. results creating liquidity faster transactions. major component a liquidity pool automated .

Defi Concepts: What Is Liquidity Pool & How Does It Work? | by

Defi Concepts: What Is Liquidity Pool & How Does It Work? | by

Liquidity pool | Definition and Meaning | Capitalcom

Liquidity pool | Definition and Meaning | Capitalcom

What Is A Liquidity Pool Crypto? - Capa Learning

What Is A Liquidity Pool Crypto? - Capa Learning

What is a Liquidity Pool in Crypto? Its Benefits and Usage

What is a Liquidity Pool in Crypto? Its Benefits and Usage

What is Liquidity Pool and its Role in the DeFi Ecosystem? - Webisoft Blog

What is Liquidity Pool and its Role in the DeFi Ecosystem? - Webisoft Blog

What is a Liquidity Pools and How Does it Work?

What is a Liquidity Pools and How Does it Work?

![What is Liquidity Pool? How does it work? [Complete Guide] What is Liquidity Pool? How does it work? [Complete Guide]](https://i.morioh.com/2021/07/30/418c4e27.webp) What is Liquidity Pool? How does it work? [Complete Guide]

What is Liquidity Pool? How does it work? [Complete Guide]

What are liquidity pools and how does liquidity providing work? - CMS

What are liquidity pools and how does liquidity providing work? - CMS

How do LIQUIDITY POOLS work? (Uniswap, Curve, Balancer) | DEFI

How do LIQUIDITY POOLS work? (Uniswap, Curve, Balancer) | DEFI

DeFi 101: What is Liquidity Pool? - Blog Rice Wallet

DeFi 101: What is Liquidity Pool? - Blog Rice Wallet

What is a liquidity pool and how does it work?

What is a liquidity pool and how does it work?