Hello, in this particular article you will provide several interesting pictures of what is covered in third party insurance.html. We found many exciting and extraordinary what is covered in third party insurance.html pictures that can be tips, input and information intended for you. In addition to be able to the what is covered in third party insurance.html main picture, we also collect some other related images. Find typically the latest and best what is covered in third party insurance.html images here that many of us get selected from plenty of other images.

We all hope you can get actually looking for concerning what is covered in third party insurance.html here. There is usually a large selection involving interesting image ideas that will can provide information in order to you. You can get the pictures here regarding free and save these people to be used because reference material or employed as collection images with regard to personal use. Our imaginative team provides large dimensions images with high image resolution or HD.

We all hope you can get actually looking for concerning what is covered in third party insurance.html here. There is usually a large selection involving interesting image ideas that will can provide information in order to you. You can get the pictures here regarding free and save these people to be used because reference material or employed as collection images with regard to personal use. Our imaginative team provides large dimensions images with high image resolution or HD.

what is covered in third party insurance.html - To discover the image more plainly in this article, you are able to click on the preferred image to look at the photo in its original sizing or in full. A person can also see the what is covered in third party insurance.html image gallery that we all get prepared to locate the image you are interested in.

what is covered in third party insurance.html - To discover the image more plainly in this article, you are able to click on the preferred image to look at the photo in its original sizing or in full. A person can also see the what is covered in third party insurance.html image gallery that we all get prepared to locate the image you are interested in.

We all provide many pictures associated with what is covered in third party insurance.html because our site is targeted on articles or articles relevant to what is covered in third party insurance.html. Please check out our latest article upon the side if a person don't get the what is covered in third party insurance.html picture you are looking regarding. There are various keywords related in order to and relevant to what is covered in third party insurance.html below that you can surf our main page or even homepage.

We all provide many pictures associated with what is covered in third party insurance.html because our site is targeted on articles or articles relevant to what is covered in third party insurance.html. Please check out our latest article upon the side if a person don't get the what is covered in third party insurance.html picture you are looking regarding. There are various keywords related in order to and relevant to what is covered in third party insurance.html below that you can surf our main page or even homepage.

Hopefully you discover the image you happen to be looking for and all of us hope you want the what is covered in third party insurance.html images which can be here, therefore that maybe they may be a great inspiration or ideas throughout the future.

Hopefully you discover the image you happen to be looking for and all of us hope you want the what is covered in third party insurance.html images which can be here, therefore that maybe they may be a great inspiration or ideas throughout the future.

All what is covered in third party insurance.html images that we provide in this article are usually sourced from the net, so if you get images with copyright concerns, please send your record on the contact webpage. Likewise with problematic or perhaps damaged image links or perhaps images that don't seem, then you could report this also. We certainly have provided a type for you to fill in.

All what is covered in third party insurance.html images that we provide in this article are usually sourced from the net, so if you get images with copyright concerns, please send your record on the contact webpage. Likewise with problematic or perhaps damaged image links or perhaps images that don't seem, then you could report this also. We certainly have provided a type for you to fill in.

The pictures related to be able to what is covered in third party insurance.html in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

The pictures related to be able to what is covered in third party insurance.html in the following paragraphs, hopefully they will can be useful and will increase your knowledge. Appreciate you for making the effort to be able to visit our website and even read our articles. Cya ~.

Management solutions insurance: What is 3rd party insurance

Management solutions insurance: What is 3rd party insurance

What is Covered Under Third Party Car Insurance Policy?

What is Covered Under Third Party Car Insurance Policy?

:max_bytes(150000):strip_icc()/third-party-insurance.asp-final-b7340589f6924533b922106d46bd6ba6.jpg) Third Party Liability Insurance Types

Third Party Liability Insurance Types

Third Party Insurance: Definition, Coverage and Importance

Third Party Insurance: Definition, Coverage and Importance

What is Third-Party Insurance? Cover, Types, Benefits

What is Third-Party Insurance? Cover, Types, Benefits

PPT - Third Party Liability PowerPoint Presentation, free download - ID

PPT - Third Party Liability PowerPoint Presentation, free download - ID

What Is Third Party Car Insurance? How Does It Work In 2023?

What Is Third Party Car Insurance? How Does It Work In 2023?

Third Party vs Comprehensive Coverage in Vehicle Insurance: Which is

Third Party vs Comprehensive Coverage in Vehicle Insurance: Which is

What Is Third Party Insurance And First Party Insurance - Cuztomize

What Is Third Party Insurance And First Party Insurance - Cuztomize

What is Third Party Insurance 2024 ? How to take advantage of it?

What is Third Party Insurance 2024 ? How to take advantage of it?

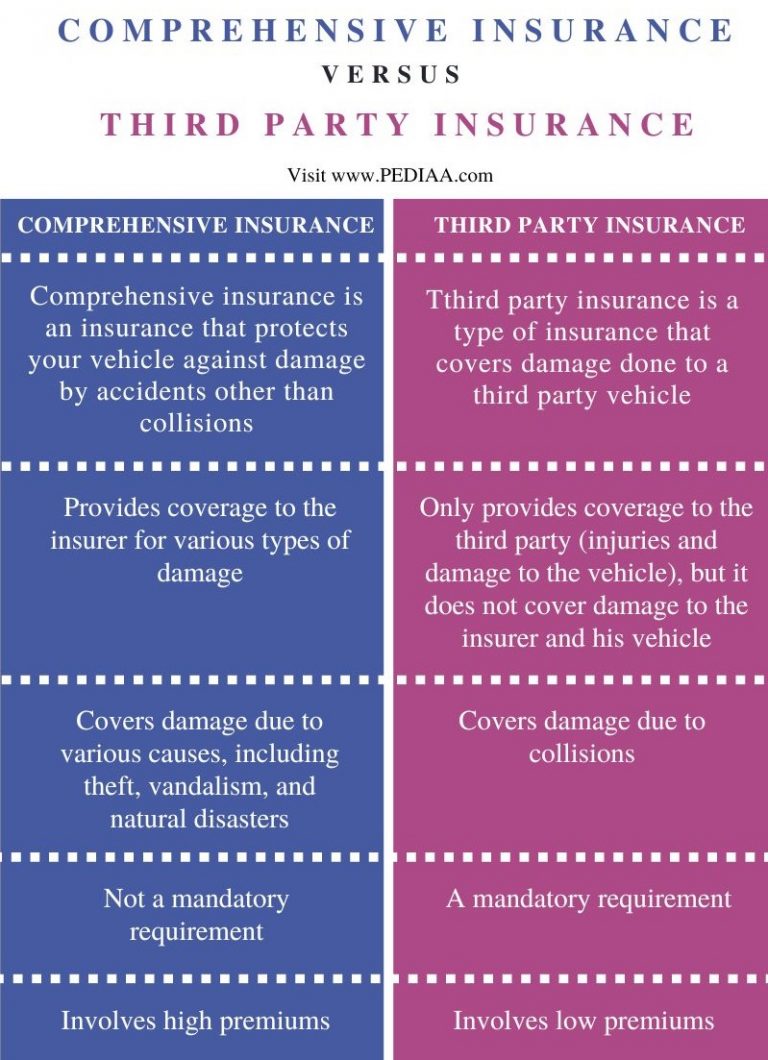

What is the Difference Between Comprehensive and Third Party Insurance

What is the Difference Between Comprehensive and Third Party Insurance

What is Comprehensive Car Insurance | Difference Between Comprehensive

What is Comprehensive Car Insurance | Difference Between Comprehensive

First Party Vs Third Party Insurance: Know the Difference

First Party Vs Third Party Insurance: Know the Difference

What Is Covered Under 3rd Party Car Insurance? - PolicyBachat

What Is Covered Under 3rd Party Car Insurance? - PolicyBachat