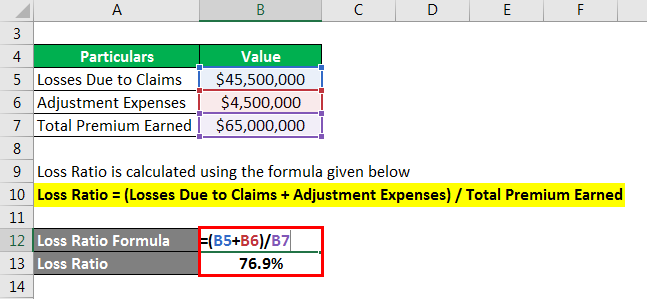

Combined Ratio Incurred Losses ExpensesEarned Premiums.

What is combined ratio in insurance industry. Published by Statista Research Department Nov 19 2020 In 2018 the combined ratio of the US. The combined ratio is a quick and simple way to measure the profitability and financial health of an insurance company. Protection From Risks Related To The Day-To-Day Running Of Your Small Business.

Ad Protect Yourself Your Business With Tailored Insurance. Property and casualty insurance industry was 99 percent and fell to 97 percent. The combined ratio which is the sum of claims and expenses incurred divided by premiums earned is a measure of profitability used by insurance companies to see how efficiently they are running.

On the flipside a combined ratio of more than 100 represents an underwriting loss which means an insurer is reliant on investment income to square the ledger. Put simply a combined ratio is a measure of an insurance companys profitability expressed in terms of the ratio of total costs divided by total revenuewhich for insurance companies translates to incurred losses plus expenses divided by earned premiums. The expense ratio is a key piece of the combined ratio which is the industry standard for measuring insurer efficiency and profitability.

Weak combined ratios CRs. Buy Online In Minutes. An insurers combined ratio measures the percentage of premiums an insurer has to pay out in claims and expenses.

Protection From Risks Related To The Day-To-Day Running Of Your Small Business. The combined ratio measures whether the insurance company is. A combined ratio CR is the measure of underwriting profitability in insurance calculated using the sum of incurred losses and expenses divided by earned premiums.

Underwriting performance is anticipated to improve in 2021 largely due to continued positive pricing momentum in commercial lines barring another year of substantially higher. Combined ratio Loss Ratio Expense Ratio Combined ratio is a reflection of the underwriting expense as well as operating expenses structure of the insurer Investment Yield Interest income rents and other investment income ----- Average total investments This ratio measures the average return on the companys invested assets before and after capital gains and losses. Insurers can have an underwriting loss a CR of more than 100 percent but still be profitable because of investment income levels.