Conversely a combined ratio of less than 100 means that a company had more earned premiums than losses plus expenses and is operating in the black while a combined ratio of exactly 100 is the break-even point.

What is a good combined ratio for insurance companies. A combined ratio of 100 might still mean the company is profitable especially if it is making significant income from its investment portfolio. Published by Statista Research Department Nov 19 2020 In 2018 the combined ratio of the US. Direct Insurers only and KPMG analysis.

It is the best calculation because it excludes investment income. Continuing with IAG and QBE the former posted a combined ratio of 1036 - an annual underwriting loss. Insurers can have an underwriting loss a CR of more than 100 percent but still be profitable because of.

Combined Ratio is a common vital indicator of a property and casualty PC insurance companys profitability. A combined ratio of more than 100 means that an insurance company had more losses plus expenses than earned premiums and lost money on its operations. Insurance experts say that the combined ratio is the best way to determine whether or not a company is making a profit.

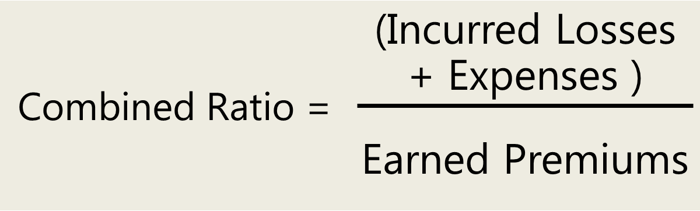

The combined ratio will be 102 or 900 million plus 120 million divided by 1 billion. A combined ratio of less than 100 percent indicates underwriting profitability while anything over 100 indicates an underwriting loss. A combined ratio CR is the measure of underwriting profitability in insurance calculated using the sum of incurred losses and expenses divided by earned premiums.

Improved its CR by 1337 points to top the list of Best Combined Ratios with an impressive industry-leading 4813. Insurance profit 4849 3889 Loss ratio 635 660 Expense ratio 248 262 Combined ratio 883 922 Insurance margin 161 136 Captial ratio 186 174 Source. Combined ratio Loss Ratio Expense Ratio Combined ratio is a reflection of the underwriting expense as well as operating expenses structure of the insurer Investment Yield Interest income rents and other investment income ----- Average total investments This ratio measures the average return on the companys invested assets before and after capital gains and losses.

The factors impacting Combined Ratio are simple - premium earned losses paid out and operating expenses. Likewise FM Global improved its CR to. Get Cover For Your Company Today And Compare Insurance With Compare The Market.

:max_bytes(150000):strip_icc()/76755050-5bfc38bb46e0fb0083c41b0e.jpg)