There are three areas you need to be aware of when it comes to split limit coverage and they are bodily injury per person bodily injury per accident and property damage coverage.

What are split limits in insurance. Many auto insurance policies use the split limits approach which combines the per person and the per occurrence approach. In this approach there are advantages and disadvantages that should be considered before purchasing car insurance. A maximum payout for certain items covered on an insurance policy such as a valuable piece of artwork on a homeowners policy.

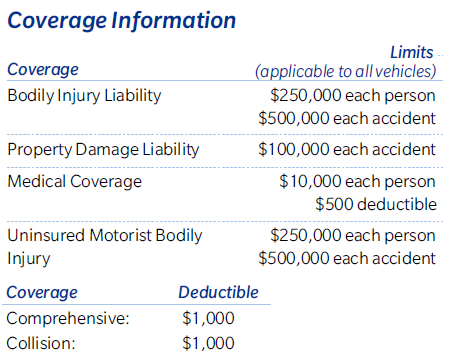

Split Limit Liability Coverage A standard Split Limit Liability coverage is broken down as a 10030050 split. One cap for bodily injury coverage one cap for property damage and one cap for all injuries for the accident. A split limit liability is the method used in determining the liability coverage of maximum amount that can be paid.

With split limits three separate dollar amounts apply to each accident. This video shows the difference between a split limit and a single limit auto insurance policy. It specifies limits for three specific types of claim.

This kind of coverage usually splits the amount of coverage three ways. Ad Compare Leading Providers and Get Our Best Insurance Deals At MoneySuperMarket. A split limit liability is the type of liability insurance that most of us are familiar with.

This is because they tend to be more narrow in scope than some other auto insurance options out there. Under the split limit coverage these numbers would mean that you have 50000 of bodily injury coverage per person per accident 100000 total for all injuries per accident and a 25000 limit for property damage done in one accident. A split limit is an insurance policy provision that states different maximum dollar amounts the insurer will pay for different components of a claim.

Split limit policies are typically cost-effective with lower premiums than other policy types. Bodily injury per person bodily injury per accident and property damage per accident. Split Liability Limits.

/commercial-auto.tmb-.png?sfvrsn=8)

:max_bytes(150000):strip_icc()/76533827-56a0d3043df78cafdaa55fd6.jpg)

/squander-money-1183142152-ad7813c7995846e49ad4e5ac4d341b3b.jpg)