The vat registration number is a unique identifier of a business operating in one of those countries, used for the purposes of managing the payment of those taxes.

Vat registration number deutsch. A typical eu vat registration number starts with the country code, such as at for austria, de for germany or pl for poland, followed by eight to 12 characters. The language of correspondence is german. Once the german vat registration process is complete, the company may use the vat number which consists of 11 characters:

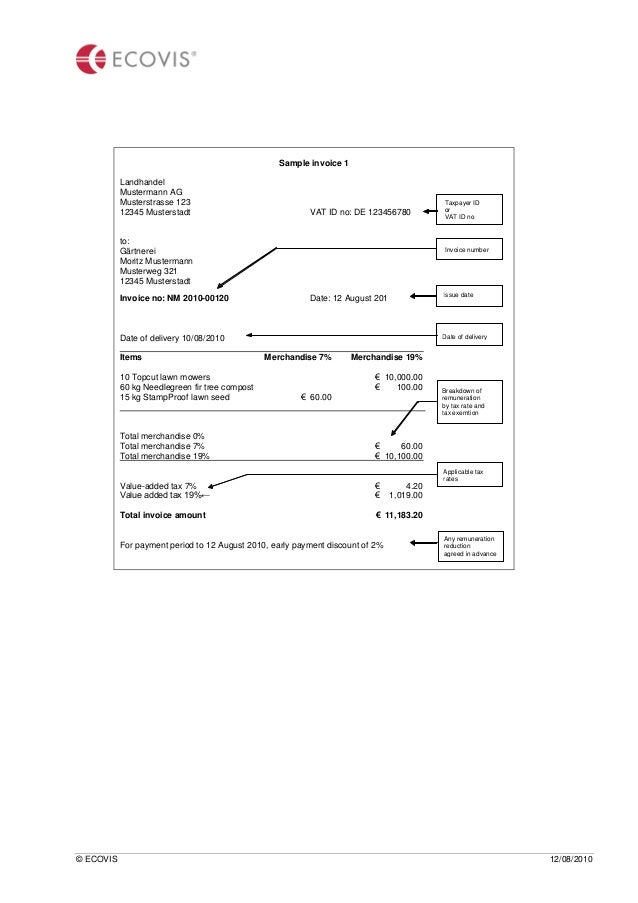

The tax office splits vat number into two: Check whether a vat number is valid. If you have a vat registration number, you can provide it to us by entering it during checkout, or.

The final two digits in the number are used for control purposes. At that time, customs and import vat were also terminated in goods trade within the european union. These are transmitted electronically to the tax authorities.

After vat registration in germany, for the first two years, the foreign company is generally obligated to submit monthly preliminary vat returns and an annual vat return. In the eu, a vat identification number can be verified online at the eu's official vies website. The value added tax identification number of db frankfurt is de 114 103 379.

This tax number can change for example when you move in another city, when marrying or when your personal clerk at the tax authorities will change. In austria, for example, the vat number starts with au followed by nine characters, the first one always being a u. It confirms that the number is currently allocated and can provide the name or other identifying details of.

A foreign business must first apply for a steuernummer at the. Who needs a vat number? The vat number does not exist.