220.0623 sale and leaseback transactions.

Sale and lease back. Under the transaction, an asset previously owned by. Evidence code section 662 provides that the owner of legal title is presumed to be the owner of the full beneficial title and that the presumption. The sale lease back allows your business to:

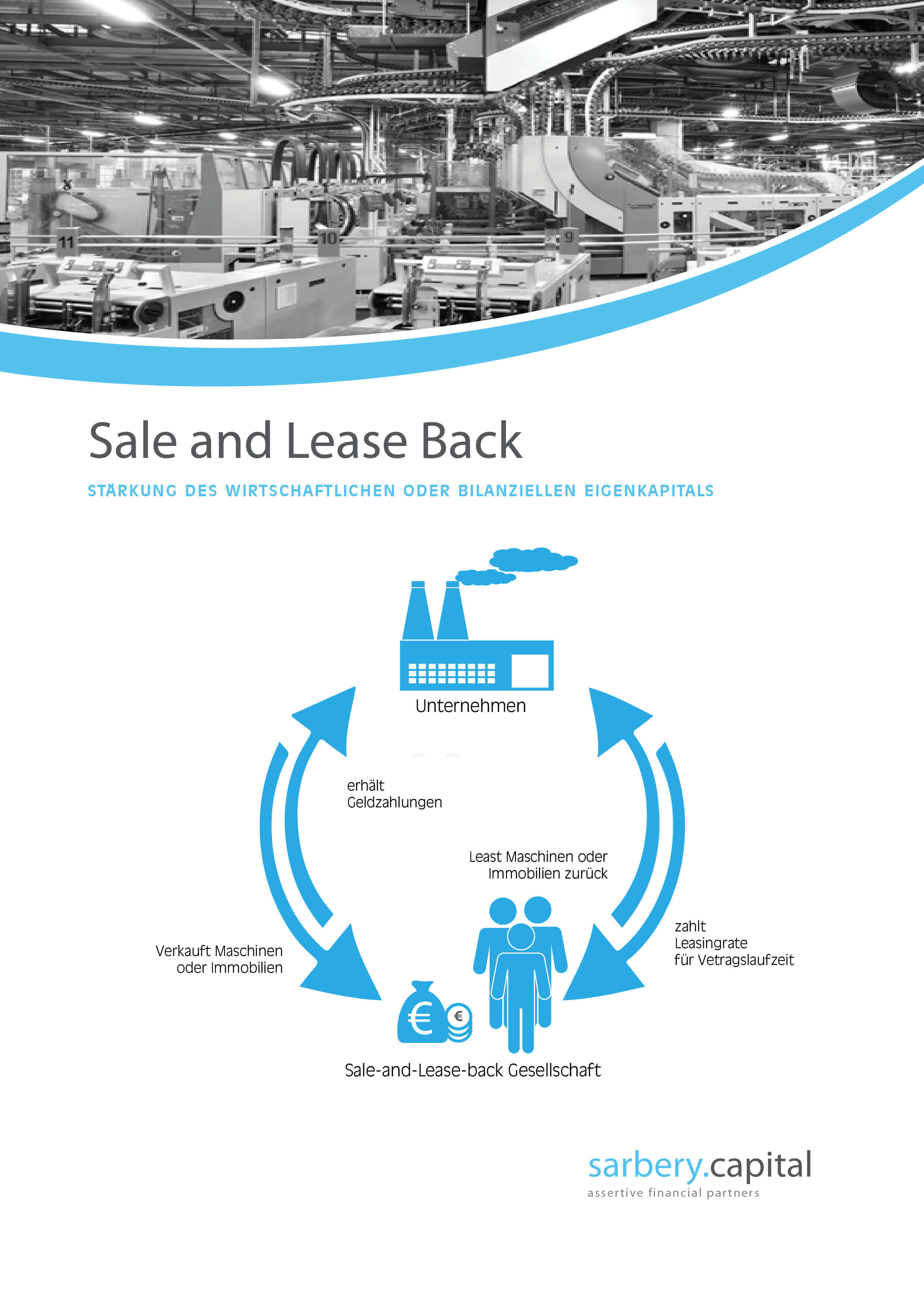

A leaseback, or sale leaseback (slb), is an arrangement between two parties. The entrepreneur sells an asset owned by the company, such as a machine. At its simplest, a sale and leaseback is the sale of a property to a third party who then leases the asset back to the seller.

Cash out your home equity while staying in your home & achieve your financial goals. What is a sale and leaseback? As the selling entity has freedom.

Sale & lease back is an alternative to traditional bank financing (investment loans, real estate loans). The seller will still use the. The company that sells the asset.

Sale and leaseback is a simple financial transaction which allows a person to lease an asset to himself after selling it. The entrepreneur sells an asset owned by the company, such as a machine or real. A sale and leaseback is a transaction in which a party sells a real estate asset with an agreement to lease the property back at an agreed rental rate and term.

Sale & lease back is an alternative to traditional bank financing (investment loans, real estate loans). This arrangement most commonly occurs. The sale and leaseback definition is a transaction in which a company sells its property to another company and then leases that property.