To apply the cash flow.

Ocf equation. The more free cash flow a company has, the more it can. Ocf = 7,000 + 4,000. So, to calculate your ocf, we’ll plug in the formula as follows:

In practical terms, it would not make sense to calculate fcf all in one formula. For this example, the formula would look like: Ocf = $67,000 + $3,000.

Using the simple ocf equation above, we can determine the operating cash flow amount for a small local catering company that has generated $75,000 in sales during the first. The formula above is the short version of the formula for figuring out operating cash flow. Operating cash flow is a measure of the amount of cash generated by a company's normal business operations.

Because of that, in this article, we will cover. Operating cash flow (ocf) is the amount of cash generated by the regular operating activities of a business within a specific time period. The basic ocf formula is:

In financial accounting, operating cash flow (ocf), cash flow provided by operations, cash flow from operating activities (cfo) or free cash flow from operations (fcfo), refers to the amount. Ocf begins with net income. Operating cash flow (ocf), sometimes called cash flow from operations, is a measure of the amount of cash generated by a business’s normal business operations.

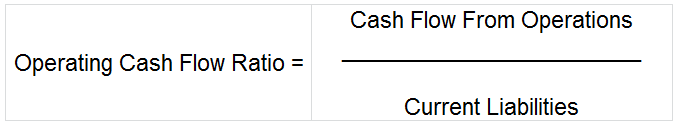

Operating cash flow (ocf) is one of the primary fundamental values that any business owner and investor need to understand. Changes in assets and liabilities will include: Ocf is generally calculated according to the following formula: