Monopolies and oligopolies can control.

Monopoly deadweight loss. In general, deadweight loss is often as a result of government policies such as price floors, price ceilings, taxation, and subsidies. The deadweight loss is the potential gains that did not go to. How to show the area of deadweight loss resulting from a monopoly.

Example #3 (with monopoly) in the below example, a single seller spends ₹100 to create a. Learn how a monopoly pricing and output strategies lead to allocative inefficiency. A market structure where there is only one firm in the industry is called as monopoly.

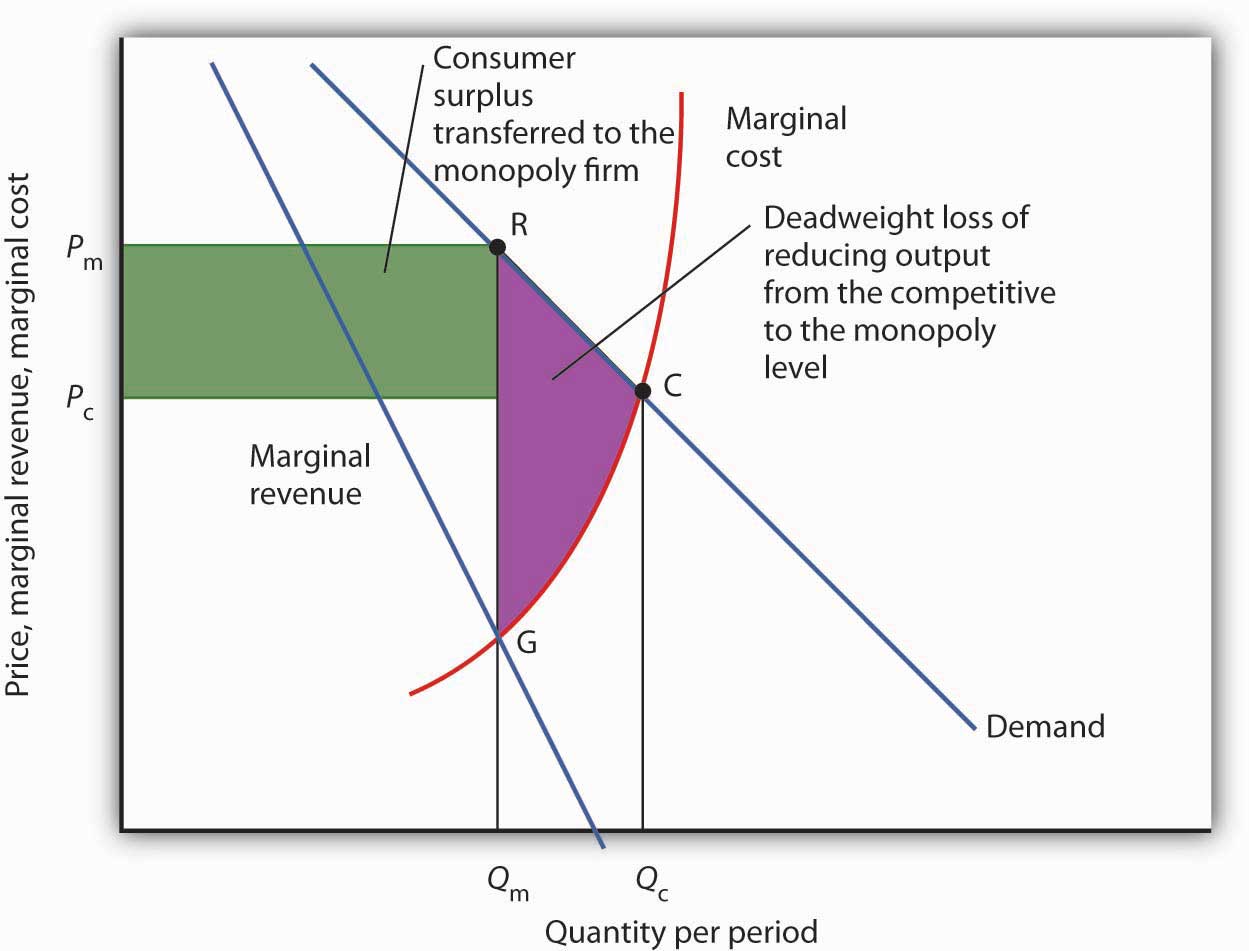

I know a subsidy shifts the marginal cost curve downwards, creating a new equilibrium price price decreases and quantity. Reorganizing a perfectly competitive industry as a monopoly results in a deadweight loss to society given by the shaded. Deadweight loss is the inefficiency in the market due to overproduction or underproduction of goods and services, causing a reduction in the total economic surplus.

Notice that monopolies charge a higher price and produce. When a government implements a sales tax, it results in the. Causes of deadweight loss can include monopoly pricing, externalities, taxes or subsidies, and binding price ceilings or floors (including minimum wages).

Therefore the deadweight loss for the above scenario is 840. The monopolist restricts output to qm and raises the price to pm. The monopoly is incurring a loss.

These alter the incentives to the producer to. Due to the this it is unlikely that such a firm will take price as given. A monopolist will seek to maximise profits by setting output where mr = mc.