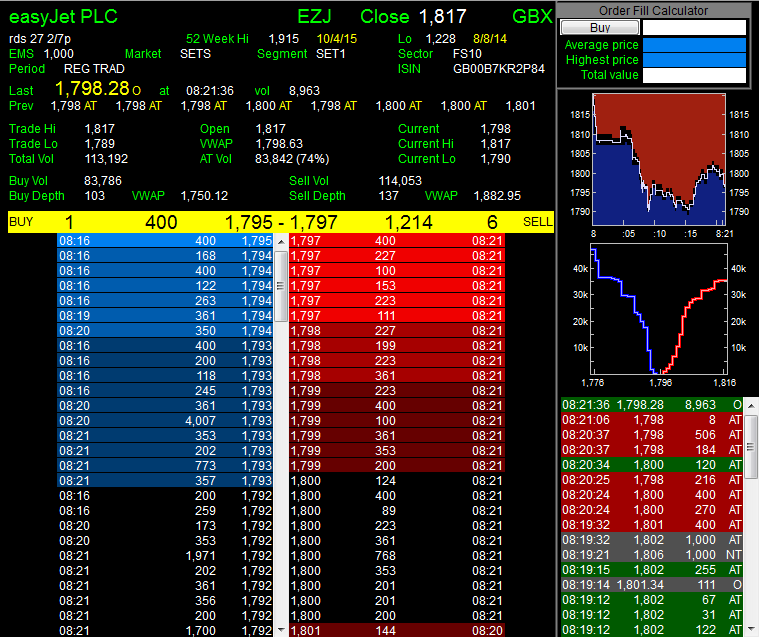

Investors can use level 2 data to differentiate between different market players such as retail and institutional investors.

How to read level ii market data. Webull level2 market data features level2 advance, a premium data feed from nasdaq total view. Use bookmap, much easier if you are new to this. Also called depth of book, level 2 includes the price book and.

The level 2 market data basically acts as an order book of sorts. Level ii market data shows multiple bid and ask prices from nasdaq for any given security so investors can better determine the availability or desire for a To understand the market depth.

The easiest way to get the webull level 2 subscription is to go to “help. When they know the market makers, they can identify their biases. Level ii shows you the best bid/ask prices from each of the many different market makers.

To open a level ii window in ninjatrader, from the control center click new > level ii. Helps you understand the dom. Level ii data is unique because it shows more than just the best bid and best ask on the market.

Typically this data is free, or delayed at most brokers. Level 1 is a very simple representation of what the buyers and sellers currently have listed as their best prices. Getting to know level 2’s market participants.

Seeing the open orders lets you make a more informed estimate about which direction the price of a stock is. Basic market data is known as level i data. For example, a level 2 entry for shares of xyz corp.