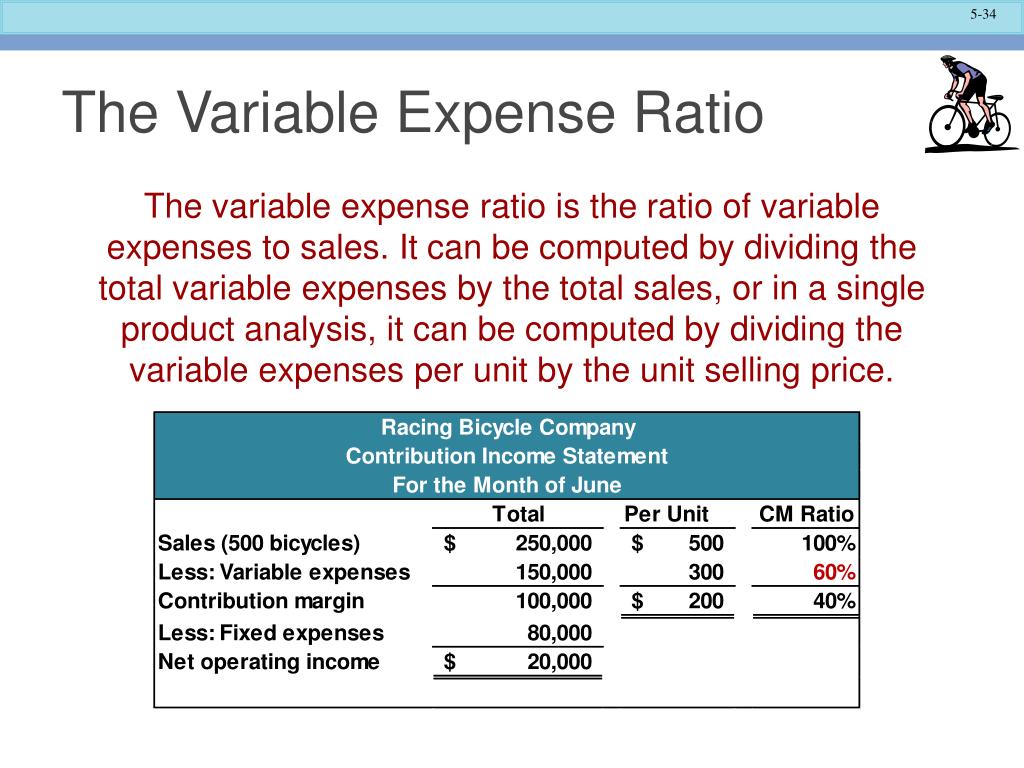

To calculate the variable expense ratio, simply divide the company’s total variable expenses by.

How to calculate variable expense ratio. The easiest way to determine the expense ratio of a mutual fund is simply to look at the fund’s prospectus. Expense ratio shows what percentage of sales is an individual expense or a group of expenses. The expense ratio formula is calculated by dividing the fund’s operating expenses by the average value of the fund’s assets.

An expense ratio is determined through an annual. To express the result as a percentage, simply multiply it by 100. The variable cost ratio is an expression of a company's variable production costs as a percentage of sales, calculated as variable costs divided by total.

Determine the expense ratio of the fund for the year 2019. Administrative expenses are $2,500, selling expenses are $3,200 and. The variable expense ratio is one of many financial ratios that help businesses see how well they are performing.

Expense ratio = management fees / total investment in the. The variable cost ratio helps determine how profitable a company is. The variable cost ratio reveals the total amount of variable expenses incurred by a business, stated as a proportion of its net sales.

For example, if the price of a product is $100. Expense ratio is calculated using the formula given below. Now, we are going to do the same calculation but with the spy etf information:

Variable cost ratio tennis $150 $200 75%. Total variable cost = 1000 * 20; As you can see, only the operating expenses are used in the.