Combined ratio insurance definition.

How to calculate combined ratio in general insurance. Ad Bi PI PL More All In One Policy Tailored To You. This ratio will indicate underwriting loss or profit per unit of gross premium charged to policyholders. As we mentioned in the introduction the ratio consists of two parts.

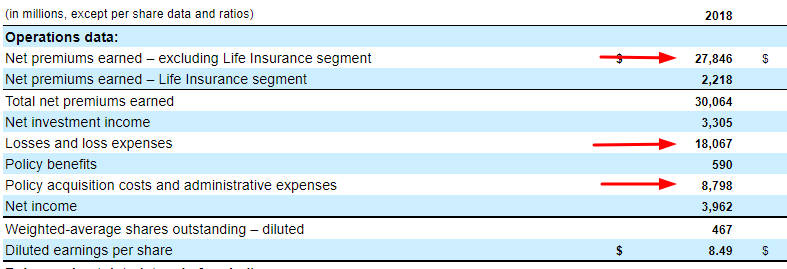

The combined ratio is essentially calculated by adding the loss ratio and expense ratio. Combined ratio This indicates a general insurance companys total outflow in terms of operating expenses commissions paid and incurred claims and losses on its net earned premium. The combination of the two ratios is called the combined ratio.

Ad Bi PI PL More All In One Policy Tailored To You. The sum of both ratios is the combined ratio. Expense ratio for an insurer would be analysed by class of business along with the trend of the same Combined ratio Loss Ratio Expense Ratio Combined ratio is a reflection of the.

We can calculate the combined ratio by taking the sum of the incurred losses and expenses and then dividing them by the earned premium. Combined Ratio Loss Ratio Expense Ratio How the experts make Combined Ratio work for them A combined ratio of less than 100 percent indicates underwriting profitability while anything over 100 indicates an underwriting loss. The combined ratio measures whether the insurance company is earning more revenues from its collected premiums relative to the claims it pays out.

The combined ratio is calculated by adding the. A combined ratio below 100 means an insurance company is operating at an underwriting profit a profit before adding the returns from investing customers premiums. Insurance companies make money by collecting more in premium revenue than they have to pay in losses and overhead expenses.

The underwriting loss ratio is defined as follows. Make sure to watch our videosCargo Misappropriation. The figure you get will be expressed as a percentage and the goal of course is to have a ratio below 100.