When you purchase real estate EO insurance you enter into an agreement with an insurer for it to pay for your loses up to your policy limits as long as you pay your premiums.

How much does e&o insurance cost for realtors. Errors and Omissions EO Insurance Costs by. The cost increases depending on the risk of a business being sued over a professional mistake. They just know they have.

This is only an estimate. How does EO insurance work. How Do Brokers Apply the Per-Transaction Costs Across their Agents.

A real estate broker managing listings worth 10 million dollars will need a different real estate EO policy from the one that is obtained by a new real estate agent. If your agents share in the payment of your EO costs some brokers will. A missing contract clause or a failure to review a sellers property disclosures could.

How much is E and O insurance for Realtors. You must purchase EO insurance PRIOR to performing any professional service. How Much does Real Estate EO Insurance Cost.

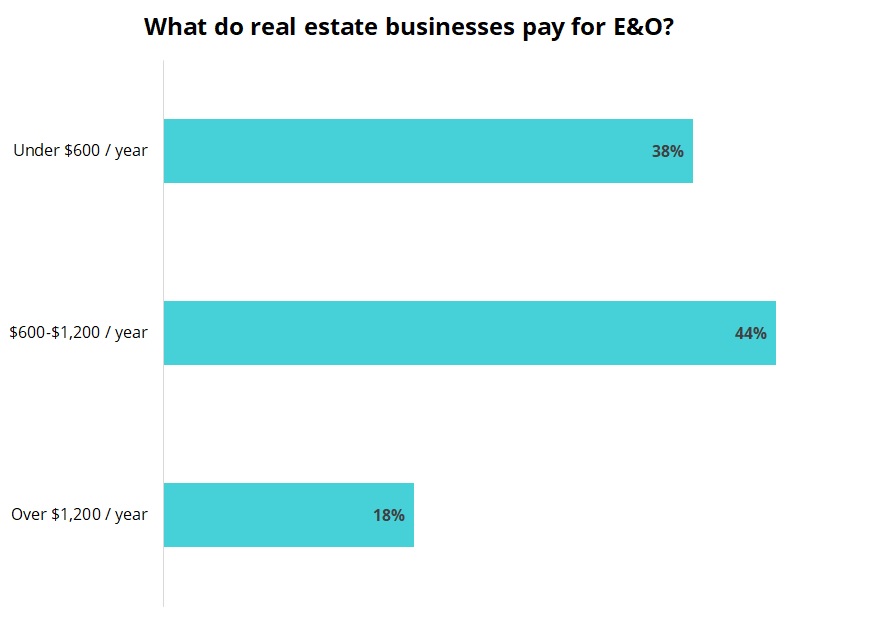

200-500year for Local Board of Realtors membership 150-350year for Multiple Listing Service membership 150year Lockbox Key to get you into homes 300-600year. The cost depends on many factors including the amount of the deductible the policy limits the size and claims history of the business. Here are some examples of how a professions level of risk can impact the cost of EO coverage.

You can purchase your insurance coverage through MyWeb. So if your business has 50 employees you can estimate your errors and omissions premium to be between 25000 and 50000 per year. The average price of a standard 10000002000000 General Liability Insurance policy for small real estate agent ranges from 27 to 39 per month based on location size payroll sales and experience.