The objective of hedge accounting is to represent the effect of an entity’s risk management activities that use financial instruments to manage exposures arising from particular risks.

Hedge accounting ifrs 9. Ifrs 9 hedge accounting applies to all hedge relationships, with the exception of fair value hedges of the interest rate exposure of a portfolio of financial assets or financial liabilities (commonly referred as ‘fair value macro hedges’). The hedging relationship consists only of eligible hedged items and eligible hedging instruments as defined by ifrs 9; This hedge experiences gains in value when the corresponding security (or ‘underlying asset’) sustains losses.

Bcin.3 ifrs 9 is a new standard dealing with the accounting for financial instruments. It is worth noting that under ifrs 9 the hedge relationship is still required to be discontinued under the following circumstances: In developing ifrs 9, the board considered the responses to its exposure draft financial instruments:

The risk management objective has changed The following description of the designation is solely for the purpose of understanding this example (ie it is not an example of the complete formal documentation required in accordance with ifrs 9.6.4.1(b)). Hedge accounting is only allowed when certain conditions are met:

The treasurer enters into a cu1m receive fixed/pay variable interest rate risk (irs) and designates the irs in a fair value hedge of cu50m of fixed rate liability (thereby setting the hedge ratio at 0.02:1). To qualify for hedge accounting, the frameworks retain complex (though different) requirements for hedge accounting. Under ifrs 9, hedge accounting continues to be optional, and management should consider the costs and benefits when deciding whether to use it.

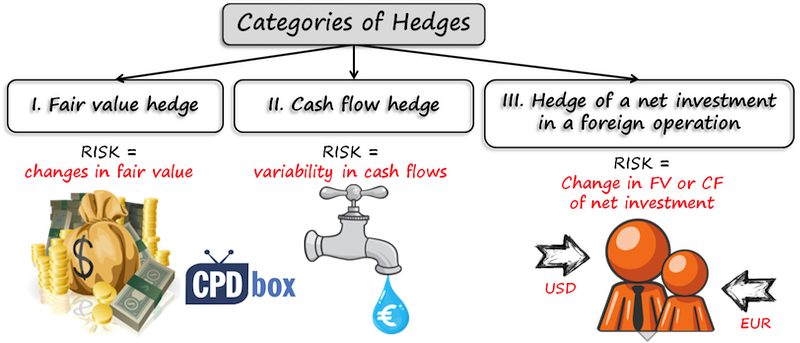

7 in paragraph 214, the. There are three types of hedging relationships: In the reporting period in which a lessee first applies the practical expedient in aasb 16 paragraph 46a, the lessee is not required to disclose the information that would otherwise be required by paragraph 106(b) in respect of the accounting policy changes made in applying the practical expedient.

Hedge effectiveness criteria are met. At the inception of the hedge there is formal documentation of the relationship; Classification and measurement, published in july 2009.