No your standard personal car insurance policy does not extend to Turo.

Does my insurance cover turo. Turo will reimburse hosts for eligible physical damage costs in excess of the deductible subject to terms and exclusions for the lesser of the cost of repair up to the actual cash value of the vehicle or 125000. Ad Whether Rain Or Shine Well Have Your Car Insurance Covered. Get your free quote now.

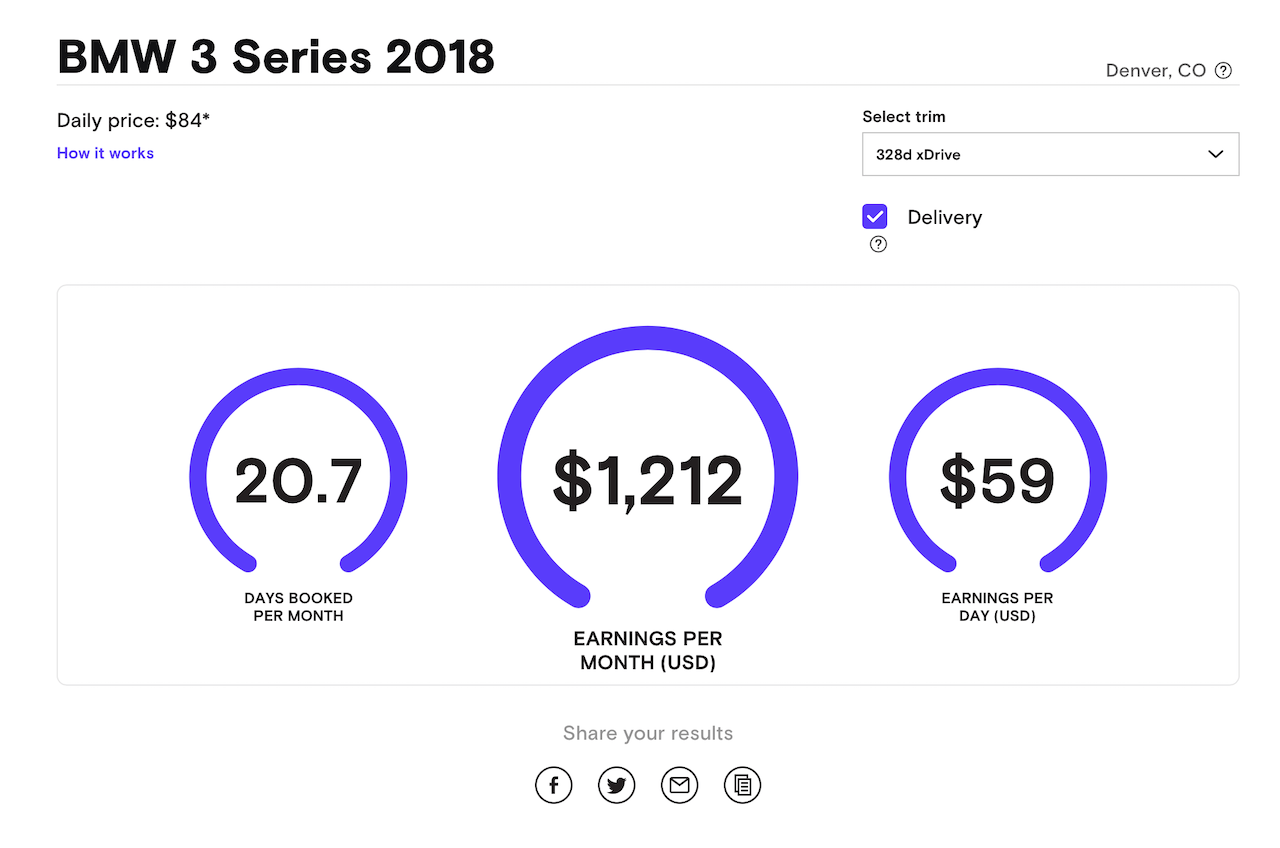

Let us Help You Save Money and Get a Better Deal. This means youll need to have both personal car insurance and additional coverage for Turo. Turo is a new company similar to Uber and Airbnb except that instead of sharing rides and rooms vehicle owners can rent their cars out to others.

Your personal car insurance policy wont cover Turo as this constitutes business use of your vehicle. Hosts and renters are given three protection plans to choose from or can decline coverage if they have their own applicable commercial or personal auto policies. Get Your Free Quote Now.

The larger policy costs 81 dollars a day. What Insurance Companies Cover Turo. Liberty Mutual is Turos insurance partner.

If youre a Turo host your personal car insurance policy will not cover your vehicle while its being rented. Another option would be to purchase a commercial car insurance policy from your insurance company and become a Turo. Some protection plans also include coverage for vehicle damage and wear and tear.

You have to purchase a Turo protection plan which supplies liability coverage through Liberty Mutual. Its unlikely that your personal carrier covers Turo trips because most insurance companies exclude rental cars and car sharing apps from their responsibility. We Are Not On Comparison Websites.