Why in the world will I need ride sharing insurance for carrying food.

Do you need special car insurance for uber eats. You will continue to pay for your plates and receive the SGI basic insurance coverage as you do today. When the Uber app is off a driver is covered by their own personal car insurance. Uber will pay an additional premium to SGI so that your basic insurance will not exclude ridesharing activity - ie.

This makes it classified as a commercial business venture and requires commercial vehicle insurance by law. When signing up to be a driver for Uber Eats you must upload proof of personal auto insurance. According to Uber Eats website.

Ubers car insurance protects you from the moment you accept a delivery to the moment you drop it off. Shop around to find the best Uber Eats auto insurance rates. In between your vehicle may not be covered by car insurance.

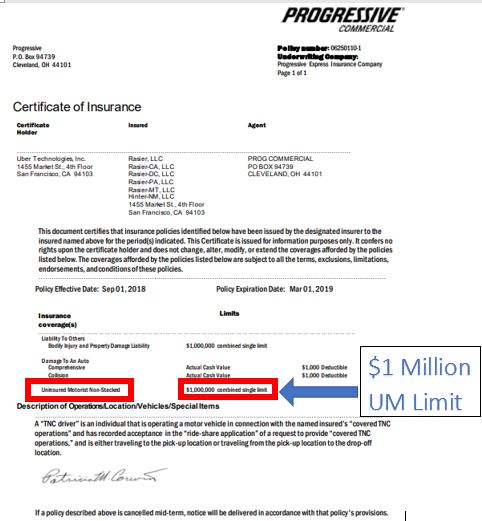

Uber provides limited car insurance to its drivers although most drivers buy extra vehicle insurance. When the Uber app. Buying Auto Insurance from Rideshare Companies Rideshare drivers do have the option of purchasing commercial auto policies.

I hope you not an Uber driver. The average cost of commercial coverage for food delivery is 27308month. As a rideshare driver in Saskatchewan you do not need to adjust your personal auto insurance policy.

Uber requires all their drivers to have car insurance and provides supplemental insurance coverage but only while the app is on. To make any type of delivery in the UK for a payment it is classified as hire for reward and requires a special type of insurance. You may need food delivery insurance if you use a personal vehicle for a service like Postmates or Uber Eats.