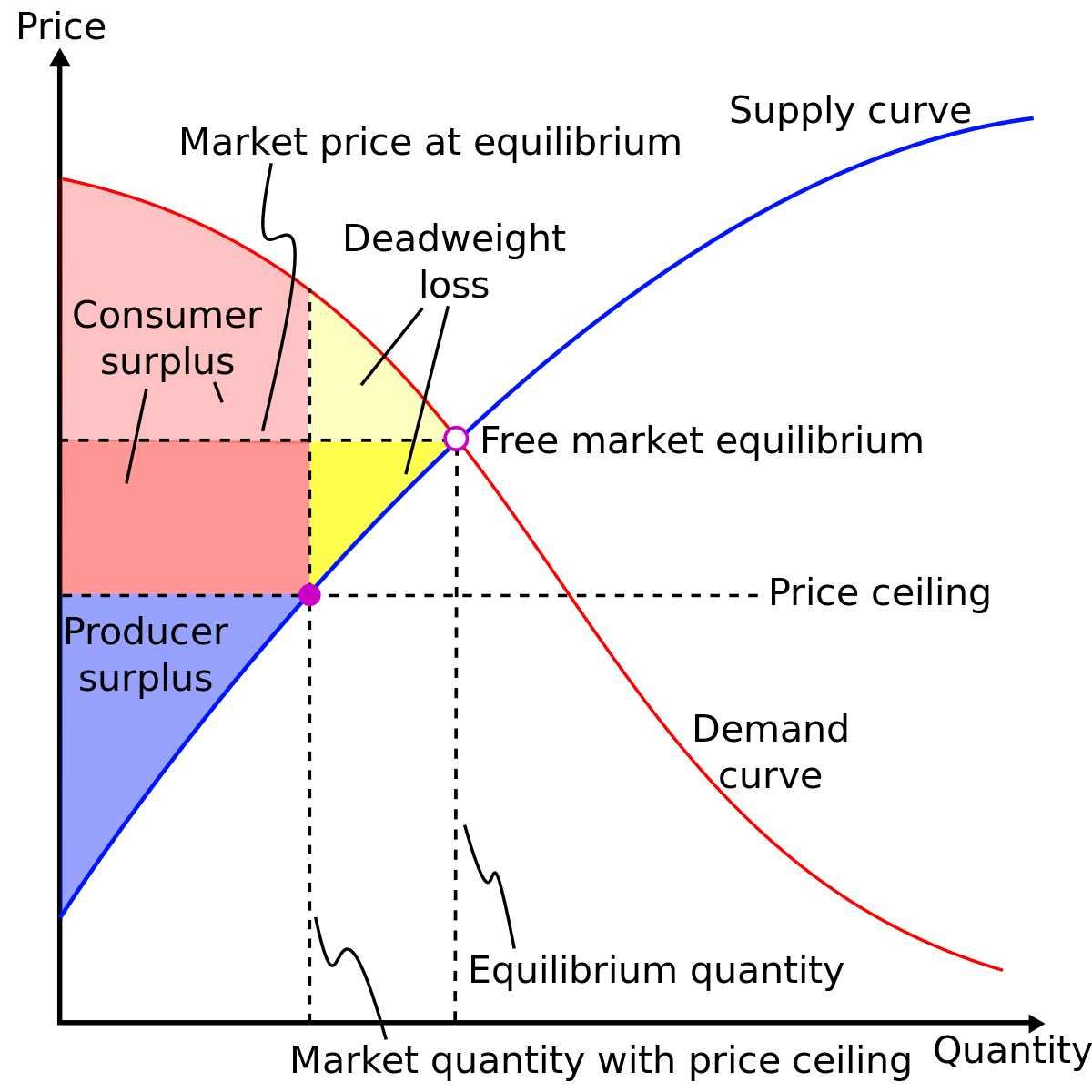

Deadweight loss can be stated as the loss of total welfare or the social surplus due to reasons like taxes or subsidies, price ceilings or floors, externalities and monopoly pricing.

Do import quotas create deadweight loss. Question 9 10 / 10 pts a major difference between tariffs and import quotas is that tariffs create deadweight losses, but import quotas do not. An import quota by a small country has no effect on the foreign country. These cause deadweight loss by altering the supply and demand of a good through price manipulation.

How do tariffs differ from import quotas a tariffs benefit domestic producers from econ misc at georgia southwestern state university The fixation of import quota leads to a rise in the price of the given commodity. It may result in a loss in consumer’s surplus for the importing country.

Importing firms or trading companies. Quotas do not affect the equilibrium price whereas tariffs do not affect the equilibrium. These middlemen would have the rights to import a fixed amount of the good each.

The national welfare effect of an import tariff is evaluated as the sum of the producer and consumer surplus and. With import quotas, there is a net. Import tariffs create deadweight loss, whereas import quotas do not create deadweight loss.

The national welfare effect of an import. An import quota lowers consumer surplus in the import market. Import tariffs create deadweight loss whereas import quotas do not create deadweight loss.

At the same time, higher price and. In order to calculate deadweight loss, you need to know the change in price and. Import quota dead weight loss: