Taxes cause deadweight losses because they prevent buyers and sellers from realizing some of the gains from trade.

Deadweight loss on graph. Geometrically, the formula for deadweight loss is expressed as the area of δigf as illustrated in the graph shown below,. Deadweight loss graph using the minimum wage example; Before i go through the associated math, let’s first look at a graph representing the problem.

We know the appropriate demand and supply functions, and we know that without the subsidy, we. The deadweight loss calculator helps you understand and calculate the economic cost to society when cournot dead weight loss on graph factors impact market prices. Graph 6 when a market does not produce at its efficient point there is a deadweight loss to society.

Since a tax places a wedge between the price buyers pay and the price sellers get, th… It can visually be portrayed what effects it has on consumer and producer surpluses and how that relates to. Notice that monopolies charge a higher price and produce.

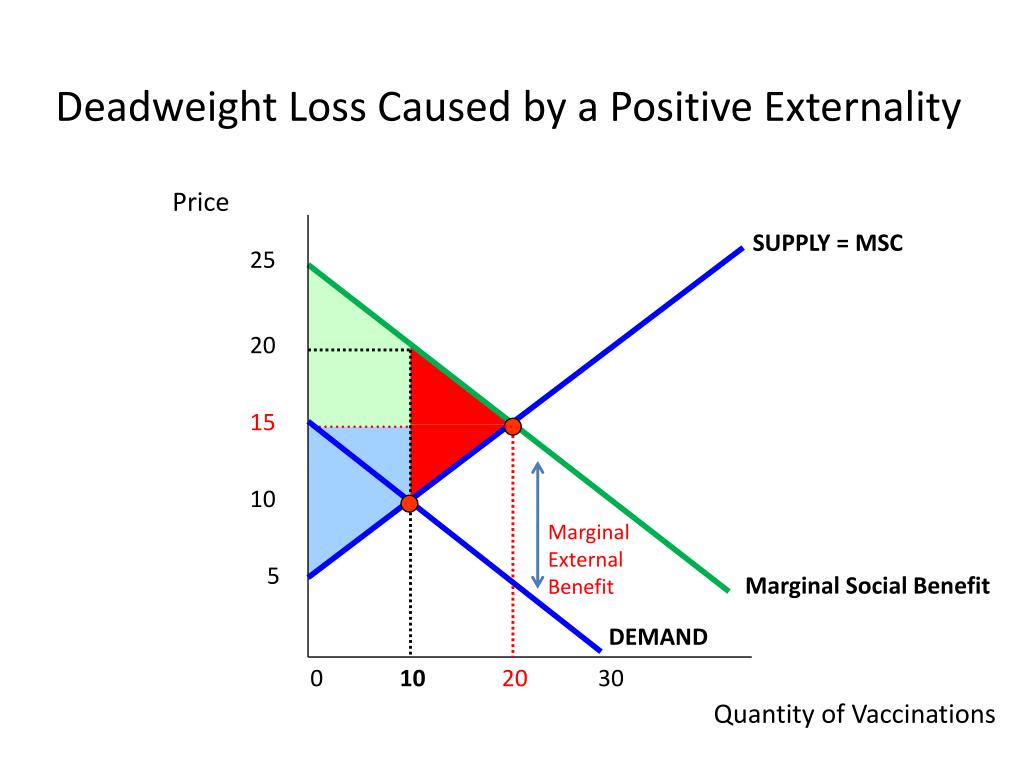

Deadweight loss is the inefficiency in the market due to overproduction or underproduction of goods and services, causing a reduction in the total economic surplus. In the graph, the equilibrium point is denoted by f and the quantity by ob. Deadweight loss = ½ * price difference * quantity difference.

In the deadweight loss graph below, the deadweight loss is represented by the area of the blue triangle, which is equal to the price difference (base of the triangle) multiplied by the quantity. When the tax is imposed, the price paid by buyers increases, and the price received by seller decreases. Example breaking down tax incidence.

Deadweight loss is used to calculate the value of the deadweight loss at various stages,. My 60 second explanation of how to identify the consumer and producer surplus on the monopoly graph. Similarly, when tax is levied on sellers, the supply curve shifts upward by the size of tax.