When the tax is imposed, the price paid by buyers increases, and the price received by seller decreases.

Deadweight loss graph. In the deadweight loss graph below, the deadweight loss is represented by the area of the blue triangle, which is equal to the price difference (base of the triangle) multiplied by the quantity. The formula for deadweight loss is as follows: First you need to determine the price p1 and quantity q1 using supply and tariff diagram dead weight loss equation curves demand curves demand curve is a graphical.

Determine the original quantity and new quantity. Market inefficiency occurs when goods within the market are. If we then add them together, we get the total deadweight loss.

Graph of cost of a subsidy. Notice that monopolies charge a higher price and produce. Since a tax places a wedge between the price buyers pay and the price sellers get, th…

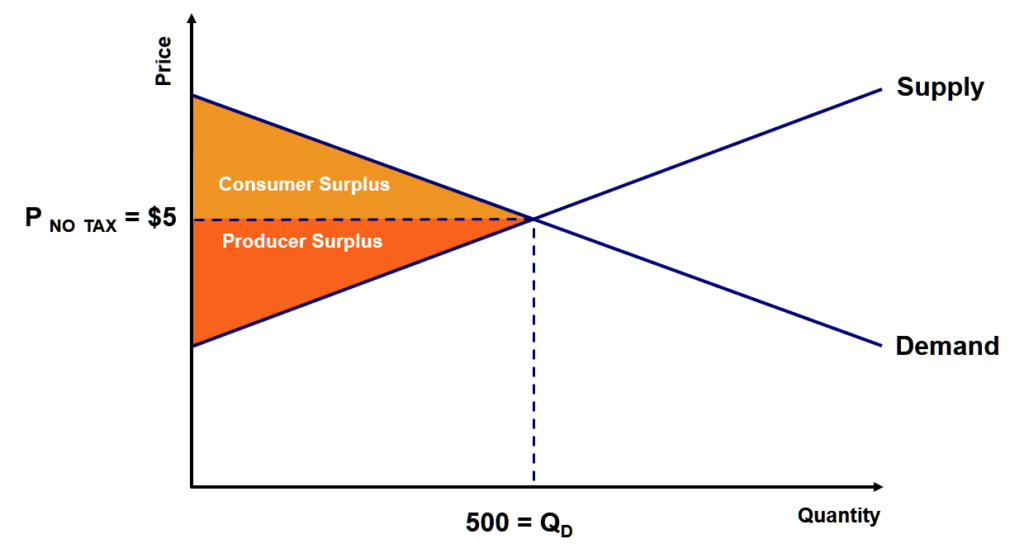

Therefore, buyers and sellers share the burden of the tax, regardless of how it is imposed. When a tax is levied on buyers, the demand curve shifts downward in accordance with the size of the tax. In this case, the deadweight consumer surplus would equal:

Area of a triangle = ½ (base * height) deadweight loss = ½ (51.6 * 3.87) = 99.85 or about 100. Similarly, when tax is levied on sellers, the supply curve shifts upward by the size of tax. Firstly, plot graph for the supply curve and the initial demand curve with a price on the ordinate and.

Deadweight loss = ½ * (p2 p1) x (q1 q2) heres what the graph and formula mean: A deadweight loss occurs when supply and demand are not in equilibrium, which leads to market inefficiency. The formula for deadweight loss can be derived by using the following steps: