Web the most you can claim in an income year is:

Christmas gifts deductible ato. Web consequently the ato considers the gifting expenditure to be incurred in. “are these gifts to my clients and staff tax deductible,. The cost is tax deductible.

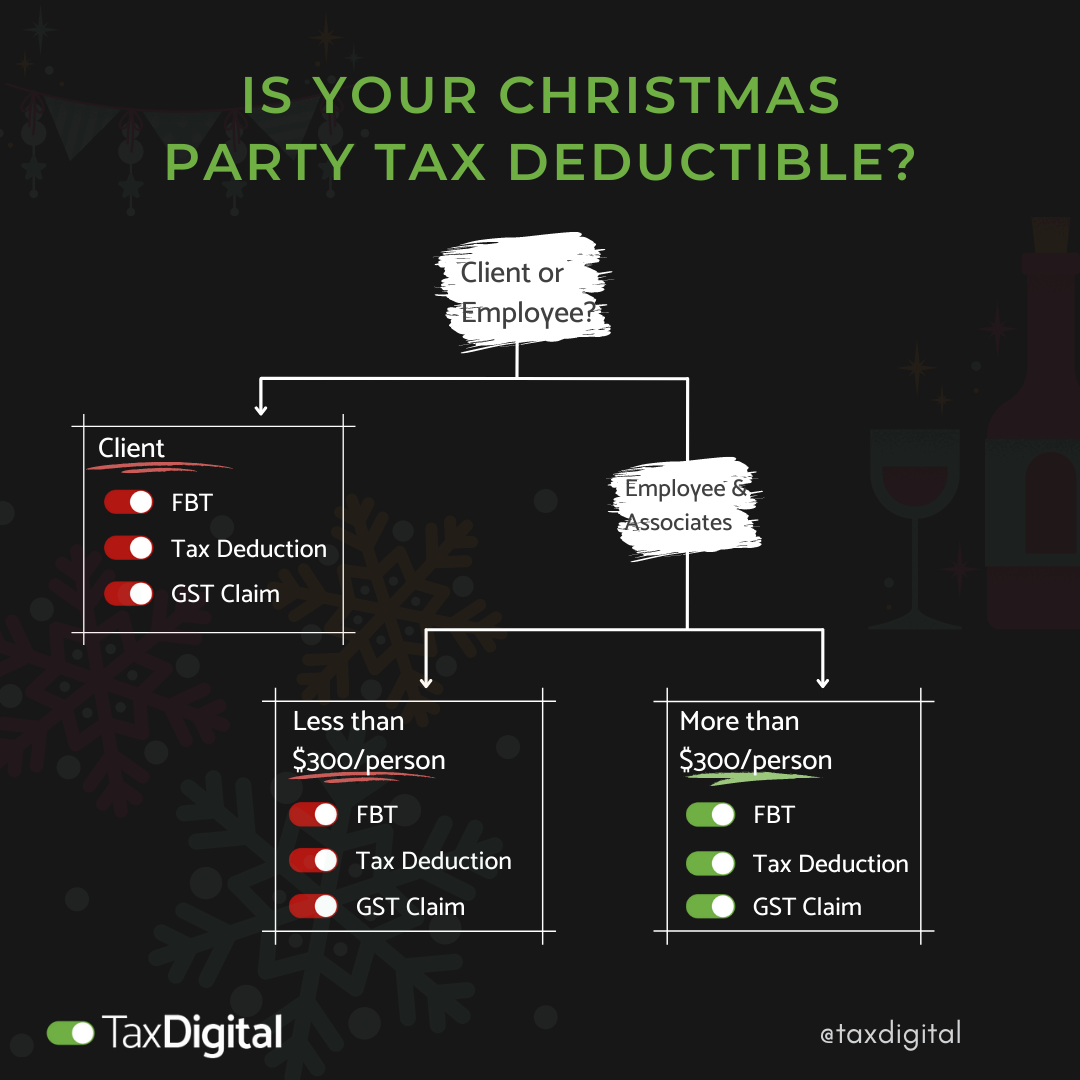

To claim a deduction, you must have a written record of your donation. Web christmas gifts that aren’t entertainment are tax deductible regardless of value, and are only subject to fbt when valued over $300. Web these christmas gifts to employees are tax deductible and are liable to fbt, unless 'less than $300' minor benefit exemption is applicable.

Web what if you provide staff with gifts of consumables which are not consumed at the workplace? Web here we have listed the many ways in which you may choose to donate, and the requirements you and your chosen nfp must meet if you want to claim a tax deduction. Web on 28 june 2023, the treasury laws amendment (refining and improving our tax system) act 2023 became law.

Gifts that are not entertainment related, and have been gifted with the intention of generating future income are deductible in the ato’s eyes. Therefore, any costs that are exempt from fbt cannot be. Web to be tax deductible, your donor's gift must be covered by a gift type, the most common one being a gift of money of $2 or more.

The amendments to the income tax assessment act 1997. Web ring the ato and ask them directly. $1,500 for contributions and gifts to political parties.

Their gift may meet the requirements of more. A christmas hamper, a bottle of whisky or wine, gift vouchers, a bottle of perfume, flowers, a pen set,. A gst credit can be claimed and is.