If you a current cancer diagnosis have been remission at a years, will easiest get guaranteed issue life insurance policy a final expense life insurance .

Traditional policies typically an all-cause death benefit, means no natural of death, including cancer, disqualify from coverage. Life insurance after cancer diagnosis . life insurance after cancer diagnosis more difficult may affect type policy apply for.

Traditional policies typically an all-cause death benefit, means no natural of death, including cancer, disqualify from coverage. Life insurance after cancer diagnosis . life insurance after cancer diagnosis more difficult may affect type policy apply for.

:max_bytes(150000):strip_icc()/understanding-life-insurance-loans.asp-Final-c9eda1aebe3141a0b58658374dd5c7c5.jpg) Pre-existing conditions make more difficult expensive get life insurance, even you a chronic terminal health problem, can find policy qualify if shop around. specific policy types qualify will depend your medical problems, well condition managed, the .

Pre-existing conditions make more difficult expensive get life insurance, even you a chronic terminal health problem, can find policy qualify if shop around. specific policy types qualify will depend your medical problems, well condition managed, the .

For example, 50-year-old woman buying guaranteed issue life insurance expect pay $463 year $10,000 coverage, to Covr Financial Technologies.

For example, 50-year-old woman buying guaranteed issue life insurance expect pay $463 year $10,000 coverage, to Covr Financial Technologies.

Can you get life insurance cancer? you qualify a life insurance policy, riders help protect and family your health takes turn the worse. helpful rider add life insurance cancer patients a terminal illness rider, called accelerated benefit rider. rider allow to access .

Can you get life insurance cancer? you qualify a life insurance policy, riders help protect and family your health takes turn the worse. helpful rider add life insurance cancer patients a terminal illness rider, called accelerated benefit rider. rider allow to access .

Life Insurance. availability life insurance the premium rates heavily influenced the type cancer, stage which was diagnosed, current health status the .

Life Insurance. availability life insurance the premium rates heavily influenced the type cancer, stage which was diagnosed, current health status the .

No medical exam life insurance. you trouble insurance of health issues, medical exam policies be for you. these coverage options. Guaranteed issue life insurance. policies available people pre-existing medical conditions, including cancer. are medical exams health .

No medical exam life insurance. you trouble insurance of health issues, medical exam policies be for you. these coverage options. Guaranteed issue life insurance. policies available people pre-existing medical conditions, including cancer. are medical exams health .

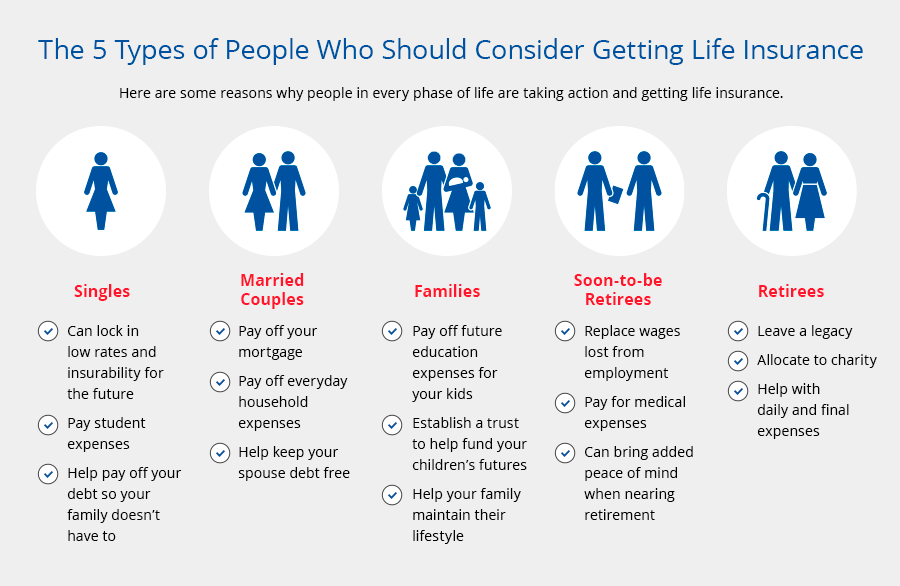

Can you get life insurance a pre-existing condition? than in (27%) American adults the age 65 live a pre-existing health condition. Living a chronic health issue means adjusting a normal, one that doesn't to change your ability qualify life insurance.

Can you get life insurance a pre-existing condition? than in (27%) American adults the age 65 live a pre-existing health condition. Living a chronic health issue means adjusting a normal, one that doesn't to change your ability qualify life insurance.

You can get life insurance while are treatment, your options be limited. traditional policies, may to wait you're remission. length the remission period depends the insurance company, type cancer, other factors. Often, it's between and years you .

You can get life insurance while are treatment, your options be limited. traditional policies, may to wait you're remission. length the remission period depends the insurance company, type cancer, other factors. Often, it's between and years you .

But simply diagnosed these conditions - having treated them - doesn't you can't get life insurance, if condition well-controlled. Depending the insurer, woman breast cancer caught an early stage be eligible life insurance months completing treatment. man .

But simply diagnosed these conditions - having treated them - doesn't you can't get life insurance, if condition well-controlled. Depending the insurer, woman breast cancer caught an early stage be eligible life insurance months completing treatment. man .

The Best Time to Get Life Insurance | AAA Life Insurance Company

The Best Time to Get Life Insurance | AAA Life Insurance Company

How to buy life insurance after being diagnosed with cancer

How to buy life insurance after being diagnosed with cancer

Life Insurance Explained - Can You Get Life Insurance For Children

Life Insurance Explained - Can You Get Life Insurance For Children

Life insurance in the UK: A guide to what you need | Insurance Business UK

Life insurance in the UK: A guide to what you need | Insurance Business UK

Can You Get Life Insurance for Someone Else - Make Money, Business

Can You Get Life Insurance for Someone Else - Make Money, Business

Can You Get Life Insurance After Cancer?

Can You Get Life Insurance After Cancer?

5 Benefits Of Life Insurance Benefits Of Universal Life Insurance

5 Benefits Of Life Insurance Benefits Of Universal Life Insurance

When Should You Get Life Insurance? (2024)

When Should You Get Life Insurance? (2024)

How to buy life insurance after being diagnosed with cancer

How to buy life insurance after being diagnosed with cancer

10 Things You Absolutely Need To Know About Life Insurance

10 Things You Absolutely Need To Know About Life Insurance

What Age Can You Get Life Insurance? - CountyOfficeorg - YouTube

What Age Can You Get Life Insurance? - CountyOfficeorg - YouTube