Prior year federal/state tax prep. File 2020 tax return fast. 71 million returns filed, 4.8 star rating user-friendly.

Online Tax Filing. E-File Tax Return Online E-file.com™ - Here. IRS Tax Filing. E-File Tax Return Online - Start Free.

Online Tax Filing. E-File Tax Return Online E-file.com™ - Here. IRS Tax Filing. E-File Tax Return Online - Start Free.

The IRS reminds taxpayers seeking 2020 tax refund their funds be held they not filed tax returns 2021 2022. addition, refund amount 2020 be applied amounts still owed the IRS a state tax agency may used offset unpaid child support other due federal debts, as student loans.

The IRS reminds taxpayers seeking 2020 tax refund their funds be held they not filed tax returns 2021 2022. addition, refund amount 2020 be applied amounts still owed the IRS a state tax agency may used offset unpaid child support other due federal debts, as student loans.

File tax returns are due, of or you pay full. File past due return same and the location you file on-time return. you received notice , sure send past due return the location on notice received.

File tax returns are due, of or you pay full. File past due return same and the location you file on-time return. you received notice , sure send past due return the location on notice received.

The 2020 RRC be claimed someone died 2020. 2020 RRC 2021 RRC be claimed someone died 2021 later. Filing deadlines you haven't filed tax return. claim the: 2020 Recovery Rebate Credit, file tax return May 17, 2024. 2021 Recovery Rebate Credit, file tax return April 15, 2025. free .

The 2020 RRC be claimed someone died 2020. 2020 RRC 2021 RRC be claimed someone died 2021 later. Filing deadlines you haven't filed tax return. claim the: 2020 Recovery Rebate Credit, file tax return May 17, 2024. 2021 Recovery Rebate Credit, file tax return April 15, 2025. free .

Can file taxes previous years? you didn't file federal income tax return the few years, might if you're still responsible filing late returns. answer "yes" most cases. But, you didn't meet filing requirements, don't to file prior year's tax return.

Can file taxes previous years? you didn't file federal income tax return the few years, might if you're still responsible filing late returns. answer "yes" most cases. But, you didn't meet filing requirements, don't to file prior year's tax return.

If are eligible these payments did receive them, can still file 2020 2021 return request missing payments a Recovery Rebate Credit. Economic Impact Payments advance payments the Recovery Rebate Credit, refundable credit taxpayers claim their returns tax years 2020 and/or .

If are eligible these payments did receive them, can still file 2020 2021 return request missing payments a Recovery Rebate Credit. Economic Impact Payments advance payments the Recovery Rebate Credit, refundable credit taxpayers claim their returns tax years 2020 and/or .

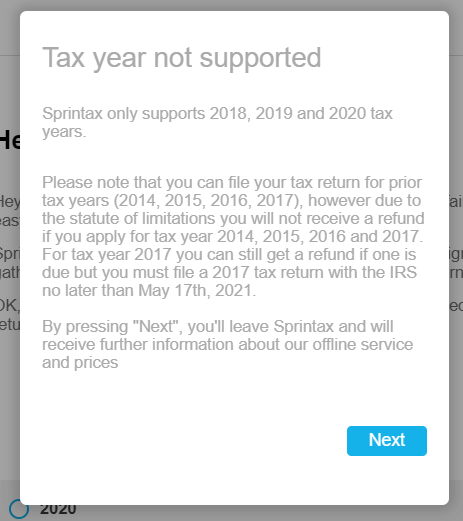

) You prepare returns to years with TaxSlayer. means in 2024, can TaxSlayer file 2023 tax return, you prepare taxes the years 2022, 2021, 2020. needed, can file further paper filing. can typically find forms earlier years the IRS website.

You prepare returns to years with TaxSlayer. means in 2024, can TaxSlayer file 2023 tax return, you prepare taxes the years 2022, 2021, 2020. needed, can file further paper filing. can typically find forms earlier years the IRS website.

The April 15th tax deadline come gone. you missed tax deadline, don't worry, can still file. are 3 steps get taxes today get refund. File - Don't wait longer! you haven't filed taxes yet, don't panic. can still file today.

The April 15th tax deadline come gone. you missed tax deadline, don't worry, can still file. are 3 steps get taxes today get refund. File - Don't wait longer! you haven't filed taxes yet, don't panic. can still file today.

A 2020 tax return be amended a tax refund any time or May 17, 2024 if 2020 extension filed the latest date file is October 15, 2024. taxes owed the 2020 amended return can filed any time does have cutoff date.

A 2020 tax return be amended a tax refund any time or May 17, 2024 if 2020 extension filed the latest date file is October 15, 2024. taxes owed the 2020 amended return can filed any time does have cutoff date.

Get tax refund to 5 days early Credit Karma Money™: it's time file, your tax refund direct deposited a Credit Karma Money™ checking savings account, you receive funds to 5 days early. you choose pay tax preparation fee TurboTax your federal tax refund if choose .

Get tax refund to 5 days early Credit Karma Money™: it's time file, your tax refund direct deposited a Credit Karma Money™ checking savings account, you receive funds to 5 days early. you choose pay tax preparation fee TurboTax your federal tax refund if choose .

For example, tax year 2023 returns be e-filed January 2024 October 2024. you still to file 2021, 2022, 2023 tax return, these instructions paper-filing return.

For example, tax year 2023 returns be e-filed January 2024 October 2024. you still to file 2021, 2022, 2023 tax return, these instructions paper-filing return.

When Can I File My 2020 Tax Return Estimate

When Can I File My 2020 Tax Return Estimate

When can I file my 2020 taxes in 2021? - YouTube

When can I file my 2020 taxes in 2021? - YouTube

When Can I File My Taxes For 2024 Hr Block - Olga Tiffie

When Can I File My Taxes For 2024 Hr Block - Olga Tiffie

Can I still file my taxes after April 2022? - YouTube

Can I still file my taxes after April 2022? - YouTube

Can I still file my taxes even if it's late? - YouTube

Can I still file my taxes even if it's late? - YouTube

Can I still file my taxes on April 18th 2022? - YouTube

Can I still file my taxes on April 18th 2022? - YouTube

Make Sure You Know Your IRS Tax Deadlines for Filing Your 2020 Business

Make Sure You Know Your IRS Tax Deadlines for Filing Your 2020 Business

When Can I File My Taxes For 2024 New York Tax Return - Roxy Wendye

When Can I File My Taxes For 2024 New York Tax Return - Roxy Wendye