In most circumstances compensatory damages are not taxable and punitive damages are taxable.

Auto accident insurance proceeds taxable. INSURANCE claims are sometimes inevitable should the worst happen. For example if youre in a car accident and incur 500 in medical expenses your personal injury protection PIP coverage would reimburse you. Gross weekly income is determined by dividing one of the following amounts by 52.

The IRS states that for the most part settlements are not taxable. Generally you will not need to pay any taxes on your auto accident insurance settlement. The Internal Revenue Service IRS has a tax law in place 26 CFR.

No Medical Questions Immediate Cover. The premiums cannot be deducted and receipts under. If you receive an auto insurance settlement part of it may be taxable.

Ad Child Cover Active Lifestyle Cover Healthcare Cover. Most car accident settlements are free from taxation meaning you the recipient will not have to pay taxes on the amount won come tax time. 13 multiplied by your gross income for the four weeks before the accident.

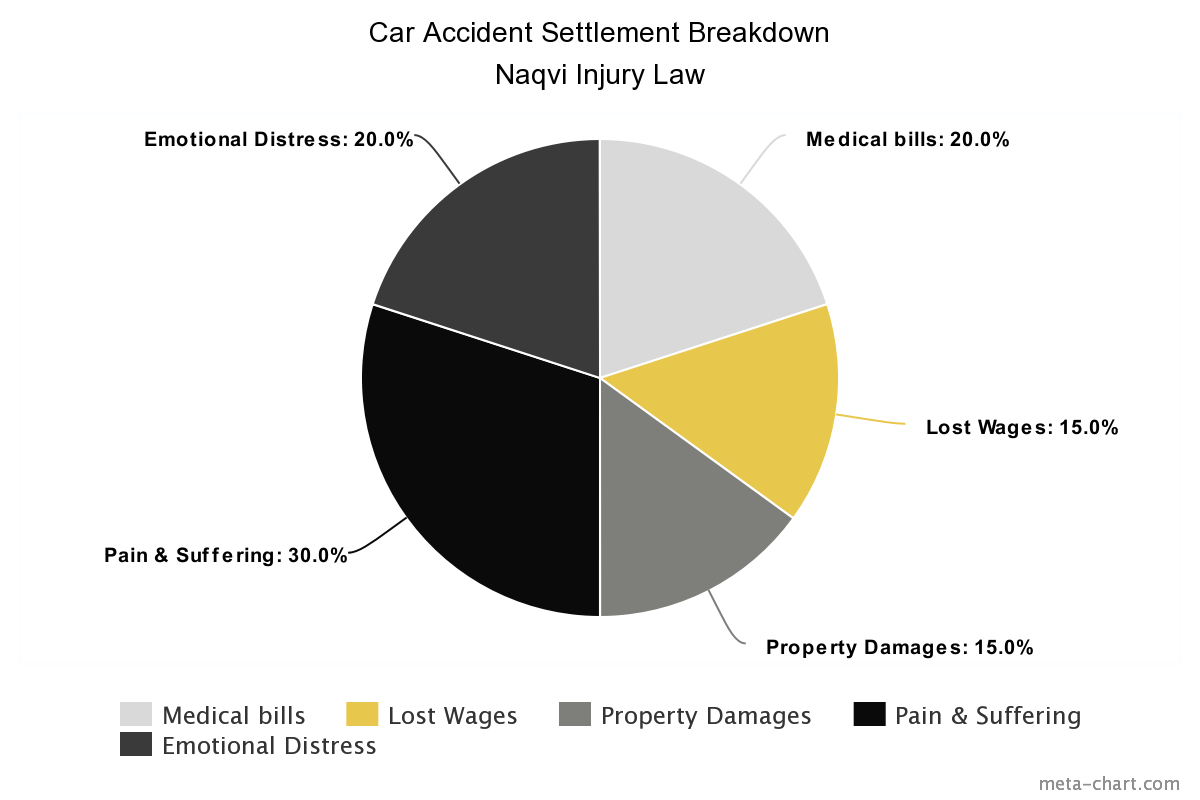

Notional tax and NI is deducted to put the claimant in the same position as if he had received the lost earnings on which he would obviously have had to pay tax. When a physical injury causes emotional injuries pain and suffering emotional distress mental anguish those damages are not taxable. On first principles periodical payments are annual payments which would be taxable as income - under ITTOIA05S422 if they are annuity payments and under ITTOIA05S683 if they are other annual.

A look at tax rules on insurance withdrawals. Everything will depend on what types of losses you received compensation for in your settlement. If its loss of earnings then the insurance payout will include a net of tax and nic although the insurance company do not pay it over to the tax man yet it still has to be declared as taxable income.