If they are taxable income to the employee, you must withhold federal, state, and local income taxes and deduct the employee's share of fica taxes (social security and medicare taxes).

Are christmas gifts for employees tax deductible. Many gifts to employees are considered a taxable benefit. If a business gives away its own goods and services (which it ordinarily trades in) to the general public either free of charge or for a subsidised payment as a method of advertising then it is treated as deductible. Only the amounts over $500 are included as taxable benefits.

Cash gifts and gift cards. Web bottle openers umbrellas golf balls hats incorporating gifts into a sale in some circumstances, a gift may be incorporated (and therefore classified) as part of a sale, as opposed to a business gift, thereby qualifying for the same tax deductions as the sale expenses themselves. A christmas party is held on a working day at your business premises and employees as well as their families attend.

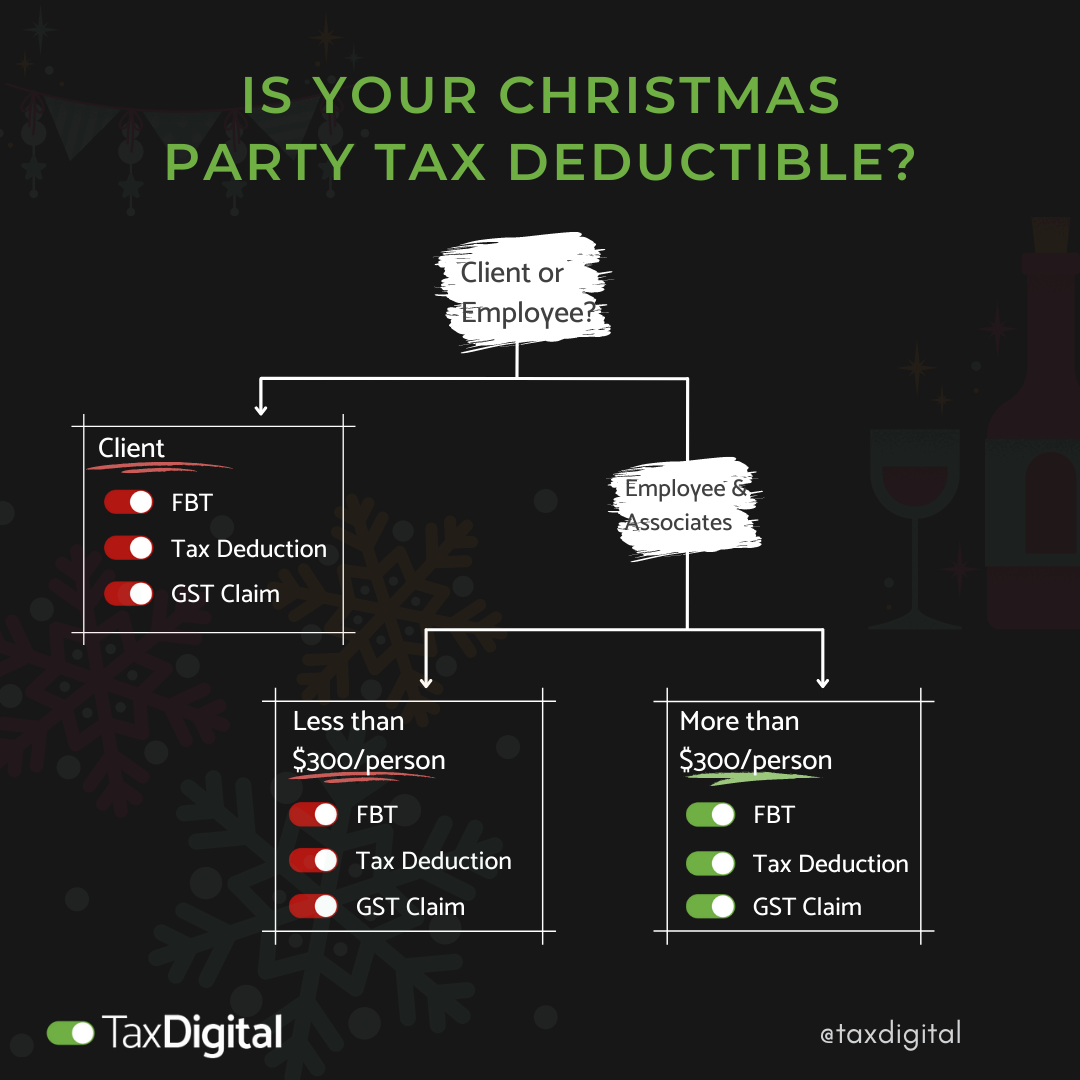

There is one exception, though: Gifts to employees as an employer providing gifts to your employees, you have certain tax, national insurance and reporting obligations. Web confusingly, even though gifts to employees are also covered by the fbt exemption, they generally are tax deductible and a gst credit can be claimed.

Can you write off gift cards on your taxes? Web are there any benefits for a business to give christmas gifts to employees? None of this generally impacts the employee.

If your gift giving extends to your clients and suppliers, the gifts should still be tax deductible with no fbt liability. Web gifts to employees. But there’s an exception for noncash gifts that constitute “de minimis fringe benefits.”

Things like a holiday turkey, candy, gift baskets or something similar are considered de minimis if the value is $25 or less. Web because only a select few of the staff are invited, the 50% meals/entertainment rule applies. De minimis means essentially too small or trivial to be counted.