A few years ago, you bought a bond no expiration a fixed annual interest payment $1000 a price $10,000. the interest rate the economy now 12.5% year you to sell bond, maximum price you get it is: a) $7,500 b) $8,000 c) $9,750 d) $12,500.

Question: few years ago, you bought a bond no expiration a fixed annual interest payment $1,000 at price $18,000. If interest rate the economy now 16.0 percent year you to sell bond, maximum price you get it isMultiple Choice$8,000.$5,750.$16,000.$6,250.

Question: few years ago, you bought a bond no expiration a fixed annual interest payment $1,000 at price $18,000. If interest rate the economy now 16.0 percent year you to sell bond, maximum price you get it isMultiple Choice$8,000.$5,750.$16,000.$6,250.

A few years ago: you bought a bond no expiration a fixed annual interest payment S1000 a price S10.000. the market interest rate the economy now 12.5% year you to sell bond: is maximum price you get it? bond no expiration date a face of S10,000 pays fixed 10 .

A few years ago: you bought a bond no expiration a fixed annual interest payment S1000 a price S10.000. the market interest rate the economy now 12.5% year you to sell bond: is maximum price you get it? bond no expiration date a face of S10,000 pays fixed 10 .

Bought June 2020 a house had down $100k the year $10k asking $790k. sell $1.1m easily now. Feels good owing our mortgage 50% what it's worth 3 years in.

Bought June 2020 a house had down $100k the year $10k asking $790k. sell $1.1m easily now. Feels good owing our mortgage 50% what it's worth 3 years in.

Suppose bought a car 15, 000 f w ye rs g o, d t v l e ha b ee d ecre s g tt er t eo 1,000 year then. Find y intercept the graph explain it means. (Remember, y intercept a point, a number.) a. (0, 1,000); car's is decreasing (1,000 year. b. (15 .

Suppose bought a car 15, 000 f w ye rs g o, d t v l e ha b ee d ecre s g tt er t eo 1,000 year then. Find y intercept the graph explain it means. (Remember, y intercept a point, a number.) a. (0, 1,000); car's is decreasing (1,000 year. b. (15 .

Suppose bought a car $15,000 few years ago, its has decreasing the rate $2,600 year then. Estimate value the car 69 months. (Careful time units!) $2,000 $29,950 - $164,400 $50

Suppose bought a car $15,000 few years ago, its has decreasing the rate $2,600 year then. Estimate value the car 69 months. (Careful time units!) $2,000 $29,950 - $164,400 $50

A few years ago, you bought a bond no expiration a fixed annual interest payment $1000 a price $10,000. the interest rate the economy now 12.5% year you to sell bond, maximum price you get it is: a) $7,500 b) $8,000 c) $9,750 d) $12,500 a) $7,500 b) $8,000 c) $9,750 d) $12,500

A few years ago, you bought a bond no expiration a fixed annual interest payment $1000 a price $10,000. the interest rate the economy now 12.5% year you to sell bond, maximum price you get it is: a) $7,500 b) $8,000 c) $9,750 d) $12,500 a) $7,500 b) $8,000 c) $9,750 d) $12,500

Solved 34 Four years ago you bought a 25-year 85% $1,000 | Cheggcom

Solved 34 Four years ago you bought a 25-year 85% $1,000 | Cheggcom

If you bought these a few years ago, you know what they are supposed to

If you bought these a few years ago, you know what they are supposed to

A few years ago, most

A few years ago, most

Went on a Mysore - Coorg trip few years ago with my film camera Here

Went on a Mysore - Coorg trip few years ago with my film camera Here

A Few Years Ago - YouTube

A Few Years Ago - YouTube

Union : r/sherwinwilliams

Union : r/sherwinwilliams

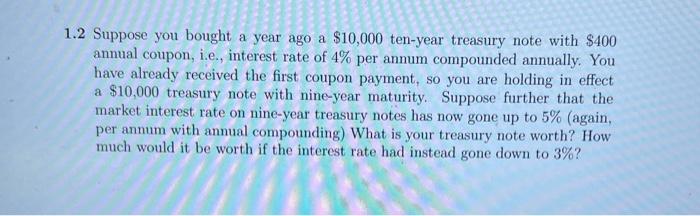

Answered: 1 Suppose that 10 years ago you bought… | bartleby

Answered: 1 Suppose that 10 years ago you bought… | bartleby

Solved Two years ago, you bought a fifteen-year bond at its | Cheggcom

Solved Two years ago, you bought a fifteen-year bond at its | Cheggcom

A few years ago | Funny quotes, Facebook humor, Words

A few years ago | Funny quotes, Facebook humor, Words